With LIBOR transition now in full swing with the first round of major index cessations at the end of 2021, the focus is now squarely on the upcoming USD LIBOR cessation deadline in mid-2023. OSTTRA has been heavily involved in the LIBOR transition from day one and through its various industry solutions. In this article, Vikash Rughani, business manager, triReduce and triBalance and Peter Altero, head of rates business development reflect on the milestones of the recent 2021 LIBOR transition. Read on to learn more about how post-trade market infrastructure adapted across compression, netting and trade processing to support firms as they navigated the 2021 RFR transition and how this post-trade blueprint supports firms as they prepare for the cessation of USD LIBOR in 2023.

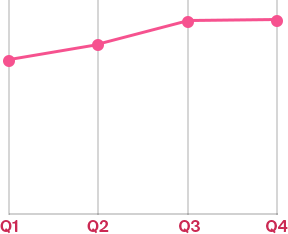

MarkitServ has supported the Secured Overnight Financial Rate (SOFR)—the benchmark chosen to replace LIBOR in the US—since 2018, when customers requested the new risk-free rates (RFRs) be added to the OTC derivatives processing platform. At the time, there were no strong data points to refer back to for these RFRs, so MarkitServ worked closely with the industry to agree on the standard conventions and market agreed trade processing capabilities required. This was so that MarkitWire could support the efficient trade affirmation, confirmation and life-cycle event processing of trades referencing SOFR instead of LIBOR. Liquidity has grown significantly since SOFR was first published in 2019. Data from September 2022 showed that around 75% of all new USD swaps were referencing SOFR. (Source: OSTTRA)

A compression roadmap

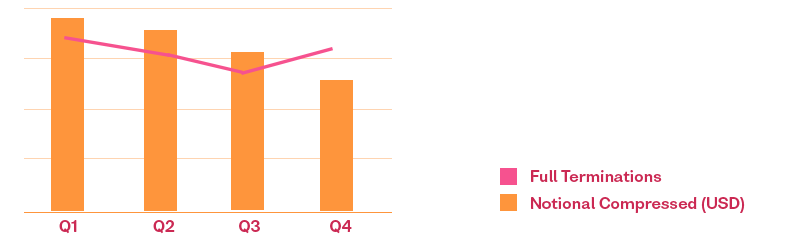

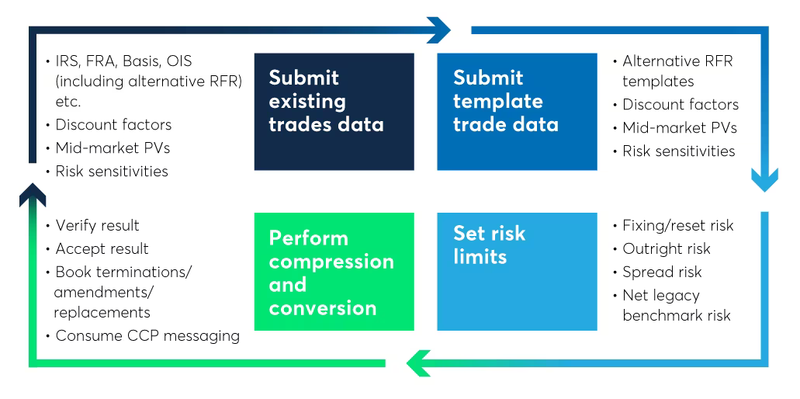

Once RFRs became available, firms began learning how to price and trade instruments referencing them, book trades in their systems and make sure they seamlessly flowed to all downstream processes, including payments and settlements. Participants began submitting those trades into TriOptima’s triReduce compression cycles, demonstrating that they could extract the transactional information necessary, obtain prices for those SOFR transactions in their portfolios, and that they were comfortable compressing trades and calculating market risk on them. To constrain the effect on market risk, firms set tolerances on the compression platform and carried out the steps needed to be able to compress RFR trades and process them downstream via the central counterparty (CCP).

As volumes started increasing in 2019, TriOptima, in support of the ARRC’s paced transition plan shared its own roadmap for proactively and iteratively reducing exposures to legacy benchmarks. By May 2020, triReduce had compressed its first SOFR swap, which became the template used for USD as well as for any other new alternative RFR. The platform can scale to whatever benchmark the market shows interest in — for example, it compressed its first Bloomberg Short-term Bank Yield Index (BSBY) swap in January 2022.

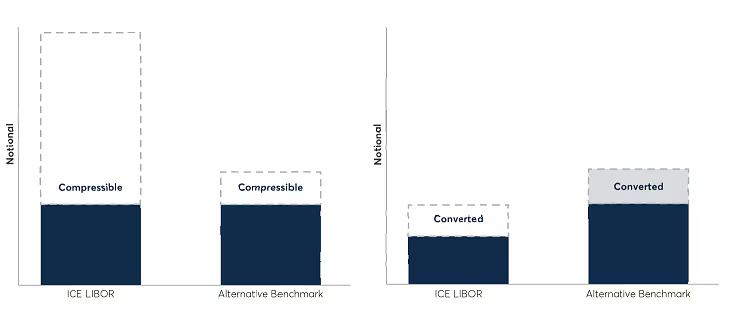

Benchmark Conversion functionality was also added to triReduce, which is a tool to further assist market participants in both reducing their gross notional exposure to legacy benchmarks and converting the remainder onto new RFRs. Firms can use this new conversion service for both centrally cleared and non-cleared OTC swaps trades and to unlock greater efficiencies.

Liquidity lessons learned from UK transition to SONIA

When the UK market began transitioning from LIBOR to the Sterling Overnight Index Rate (SONIA), there was little liquidity over 18 months, because SONIA swaps had traditionally been a short-dated instrument. For instance, if a firm had a 20-year LIBOR exposure they wanted to convert, there were no equivalent SONIA trades available to replicate or offset against. TriOptima’s innovation extended the capabilities of their service to enable banks to create new trades they were confident to price even though they had not yet executed many similar trades in the new benchmark.

More recently, it has been a similar situation with SOFR. In the beginning, SOFR liquidity did not go beyond three years. The industry had a chicken and egg problem of how to grow the duration of the SOFR curve. So how was this done?

Firstly, trade booking was enabled through the MarkitWire platform, which allowed firms to enter into longer-dated trades. Then there was the discounting switch in 2019, where CCPs’ discounted cash flows for both variation margin (VM) and initial margin (IM) from Federal funds over to SOFR. Overnight, this put firms into long-dated SOFR exposure they needed to hedge. Although it is mostly dealers that are active in hedging their discounting risk, this acted as a significant catalyst for building liquidity at the longer end of the SOFR curve.

A trade processing blueprint for USD LIBOR transition

USD market participants are currently running through questionnaires internally and planning for the upcoming benchmark conversion. OSTTRA has a proven blueprint that was successfully adopted by the industry during the first four currency conversions: Swiss Franc, Euro, Yen and Sterling. The combined experience of Markitwire and triReduce coming together in one company allows for a comprehensive suite of solutions aimed at mitigating risk and providing firms with tools that allow them to manage their exposure ahead of USD LIBOR benchmark cessation.

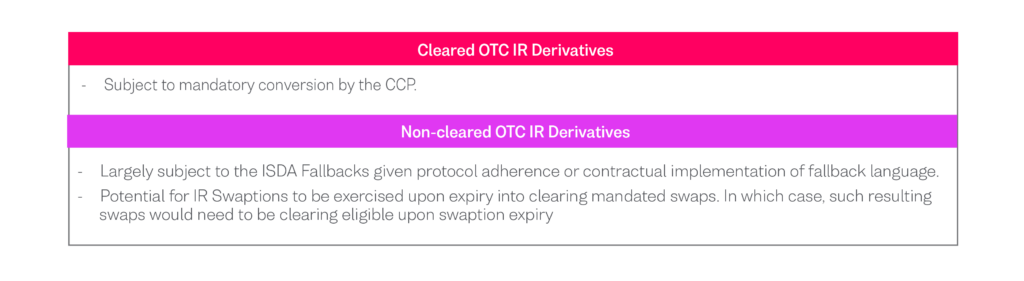

OSTTRA offers platforms that scale to meet the challenge of larger volumes as well as the functionality to help with the conversion of legacy benchmark risk. OSTTRA also supports the legal aspects of transactions under the International Swaps and Derivatives (ISDA) fallbacks Protocol. In late 2020, MarkitServ partnered with ISDA and engaged with customers via its industry working groups to explain how their rulebook would incorporate the ISDA Fallbacks Supplement and to help dispel any ambiguity as to whether new and legacy non-cleared positions were protected by the Fallbacks Supplement and Protocol. In the few scenarios where it was not straight-forward to determine if such positions were protected by this framework, such as in a legal novation of an existing bilateral transaction, OSTTRA MarkitWire implemented a new field enabling the remaining party and transferee to incorporate the IBOR Fallbacks Supplement.

“2021 brought a lot of change including LIBOR-SONIA conversion, the October 2021 [definition change], as well as all of the Uncleared Margin Rules (UMR) deadlines. When so many industry-wide events occur in short succession, firms tend to focus only on the most imminent priority. As a result, many firms did not take advantage of resources available to them, like the clearinghouse conversion dry runs that were taking place in advance of the CCP Conversion related exercises for Swiss Franc, Euro, Yen and Sterling. This was a missed opportunity that firms will be seeking to learn from this time around.”

Tackling transition burden with netting synchronisation

The conversion of legacy LIBOR transactions into the alternative RFR, SOFR, is a once-in-a-lifetime transition. Building tools or capabilities to support the transition process and consuming message feeds from the clearinghouses represent a meaningful amount of sunk cost for a limited-use build.

The OSTTRA MarkitWire CCP Synchronisation service provides two-way API connectivity between the MarkitWire interface and the clearinghouse, built natively to support different post-trade events on cleared trades. As an example, firms using OSTTRA triReduce to compress trades – with the output of full terminations and risk replacement trades—can simplify their internal build and support costs through the CCP synchronisation API. Most firms which leverage OSTTRA MarkitWire for rates trade processing workflows connect to the interface via a proprietary API which feeds directly downstream into their risk system. CCP synchronisation is built off this same API which consolidates BAU flow with post clearing activity. Firms can reap the benefits of connecting once through a familiar interface to process termination and risk replacement trades across 6 different clearing houses, as well as compression/optimisation vendors who service the cleared interest rates community.

When clearinghouses announced they would perform bulk cleared conversions, the OSTTRA CCP synchronisation tool helped normalise workflows for clearing participants. CCP synchronisation was utilised for both the basis swap splitting exercises and the subsequent legacy benchmark conversion exercises in 2021. OSTTRA supported firms through the conversion events in all four currencies through a standard interface across The Japan Securities Clearing Corporation (JSCC), Eurex, the Chicago Mercantile Exchange (CME) and LCH, resembling a multi-tenant multi-clearinghouse offering. It will now be extended to USD as well as to any further conversion events performed by these and other CCPs.

Instead of multiple—often manual—processes, this is all automated through a single highly-scalable platform. OSTTRA has undertaken extensive performance testing to ensure resilience in the face of the extreme volumes that are widely expected to be processed during these future exercises.

Dry runs offer an opportunity for rehearsal before transition

2021 brought a lot of change including LIBOR-SONIA conversion, the October 2021 definition change, as well as all of the Uncleared Margin Rules (UMR) deadlines. When so many industry-wide events occur in short succession, firms tend to focus only on the most imminent priority. As a result, many firms did not take advantage of the clearing house conversion dry runs that were taking place in advance of the CCP Conversion related exercises for Sterling. This was a missed opportunity that firms will be seeking to learn from this time around.

Considering the sheer size of the USD LIBOR swap population, firms should plan to participate in the dry runs being run by the CCPs. Some are already working with OSTTRA MarkitWire to facilitate the backloading of production-like portfolios into the OSTTRA MarkitWire UAT environment which is linked to test environments of global clearing houses so they can maximise the value of those dry runs.

In addition, firms are preparing to support all variations of SOFR swaps that will be created as part of the CCP conversion exercises and in many instances may not have traded such variations before. Firms prefer to see the results of the USD dry runs feed OSTTRA MarkitWire UAT as the environment is connected to their risk system, enabling portfolio pricing simulations.

A major lesson learned from last year is that firms can never start their planning early enough. At the start of 2021 many firms were surprised that the CCPs were not simply going to implement the ISDA Fallbacks but would legally convert legacy benchmark trades to the alternative RFR. In turn, it took firms some time to understand the corresponding need to reduce their exposure to not only index cessation but also to the CCP conversion exercises by getting down to their core net risk positions.

As part of the CCP conversion exercise, every single trade that is subject to cessation is run through the conversion process, leading to a doubling or tripling of the number of trades in their book. Firms must consider the impact such an explosion in trade count and notional would have on operational processes and technology infrastructure.

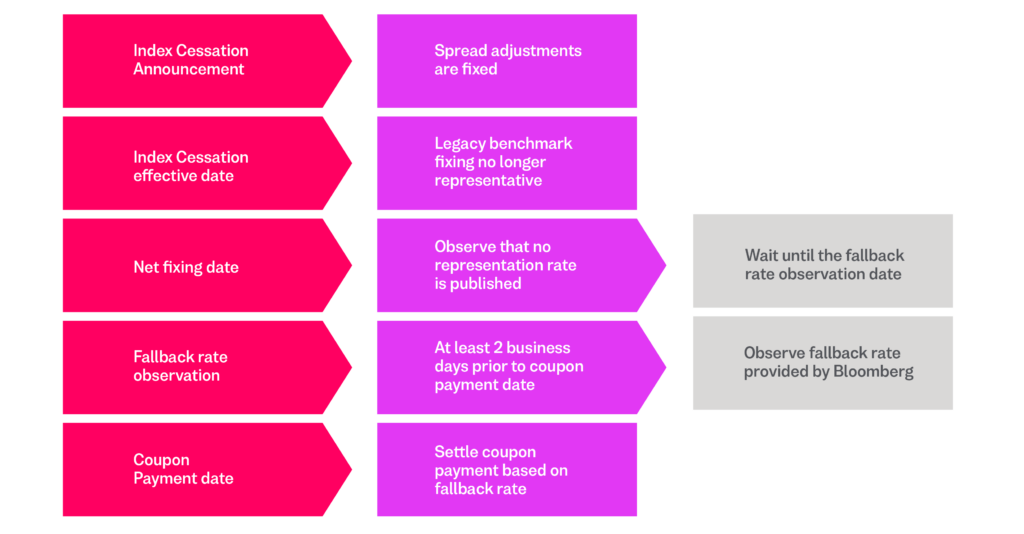

Even for non-cleared trades, from both a technological and operational point of view implementation of those fallbacks was not straightforward. Firms have recognised that the shift from term rates to compounded in arrears rates means that whereas a coupon payment would be known three months in advance for a typical LIBOR swap, in a SOFR world, the payment is only known two days prior to payment date. This means firms may only have two days to resolve any breaks with their counterparties. OSTTRA triResolve, the daily reconciliation platform that enables firms to discover and fix breaks proactively, can assist by tracking potential sources of reconciliation breaks throughout the coupon period and until the coupon payment is actually settled.

Compression via OSTTRA triReduce helps shrink the number of outstanding swaps down to the core net risk position and mitigate risks relating to the conversion exercises. It also enables firms to consciously and, in a risk-based manner, convert their risk from legacy benchmarks onto the alternative RFR—whereas the CCP conversion exercises approach it at a trade-level. Between now and June 2023, firms can chip away every two weeks at their ticket count and overall Libor exposure, converting over to SOFR in a single battle-tested process. The more they reduce their pool of outstanding legacy swaps, the less the CCP conversion runs will impact them.

Unique challenges for the USD market

The choice of alternative USD rates was not as straightforward as with other currencies. SOFR is based on a particular segment of the market and most importantly – actual transaction activity. However, that transaction activity is rooted in the repo market. SOFR, a secured rate, behaves very differently from LIBOR by virtue of not having a credit component and not being a term rate.

“The conversion of legacy LIBOR transactions into the alternative RFR, SOFR, is a once-in-a-lifetime transition. Building tools or capabilities to support the transition process and consuming message feeds from the clearinghouses represents a meaningful amount of sunk cost for a limited-use build.”

Key takeaways

Firms should start early and engage their vendors to understand the services available to assist them during this momentous time. They should participate in any dry runs that are offered and encourage consistency where appropriate between clearinghouses.

They should also look at their legacy stock of trades in both the cleared and non-cleared worlds across all global desks & books without forgetting products like non-cleared cross-currency swaps where a significant portion of trades utilise USD LIBOR as the interest rate benchmark on one side.

So much energy has gone into establishing SOFR and making it the market standard over the last four years. Now, even if firms want to transact using LIBOR, this rate is quoted with reference to SOFR. Any LIBOR trades that go beyond the end of 2023, will turn into a quasi-SOFR trade from a valuation and risk perspective and should therefore be viewed as such following the cessation date. Firms then need to assess what their exposure to LIBOR will look like over the next 12 months and how LIBOR volatility might be impacted by the winding down of legacy exposures in the benchmark.

For more information regarding Benchmark Reform click here or contact us.

Authors

|

|

Vikash Rughani

Business manager, triReduce and triBalance |

Peter Altero

Head of rates business development |