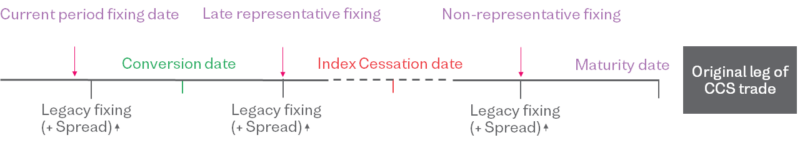

Our cross-currency swap conversion service offers proactive conversion of non-cleared cross currency swaps that reference legacy benchmarks. The service provides flexibility whilst mitigating the risks involved in converting to the new alternative RFRs.

Standard Ibor-Ibor USD-CAD CCS trade

| Before Conversion | After Conversion | |

| Floating Rate Index | CAD-CDOR | CAD-CORRA-OIS-COMPOUND |

| USD (resetting) leg | USD-LIBOR | USD-SOFR-OIS Compound |

To minimise risk impact and resulting PV difference subject to cash compensation, the conversion process generates overlay transactions in the form of market standard cleared interest rate swaps and overnight index swaps. Only a small residual PV impact from the conversion is settled in cash between the participants of the run, making the process market risk neutral.

Cleared overlay trades

Highlights

- Conversion method

Participants select single-leg or full-trade conversion chosen at a currency pair level

- Conversion Spread

This is pre-defined ahead of the exercise & applied to the non-resetting leg of the amended cross-currency swap

- Maximum Transparency

All participants will be aligned on the conversion method & the conversion spread leading into the exercise

“Our engagement with the industry over the last two years highlighted that market participants are committed to finding innovative solutions to reduce their exposure to legacy benchmarks. We are pleased to provide our non-cleared conversion service to help market participants overcome the technological and operational challenges of implementing fallback procedures and waiting until the deadlines for the respective legacy rates.”

– Vikash Rughani, Business manager at OSTTRA triReduce and triBalance

The service is available to customers with legacy benchmark exposure in cross-currency swaps referencing any indices subject to cessation, including those in MXN, PLN, ZAR and CAD.

Delivered by OSTTRA triReduce and triBalance, non-cleared trade amendment and connectivity to CCPs for the overlay swaps are provided via OSTTRA MarkitWire.