Manage the transition of legacy benchmarks in OTC swaps portfolios

Eliminate legacy benchmark transactions from OTC swap portfolios whilst proactively and iteratively converting the remainder onto alternative reference rate benchmarks. OSTTRA’s Benchmark Conversion cycles allows firms to manage the pace of their benchmark transition.

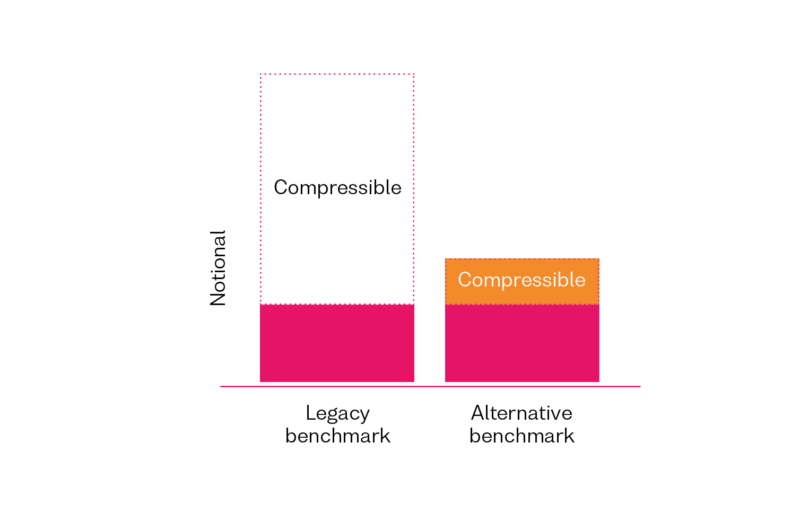

Compression first…

Maximise gross notional reduction in legacy and alternative benchmark swaps.

- Multilateral compression helps market participants reduce their gross notional and line items while keeping their swap positions market risk neutral overall.

- In triReduce compression cycles, gross exposures are brought down towards each firm’s core net risk position.

- Simultaneous compression in the alternative benchmark helps keep overall gross notional down throughout the conversion process.

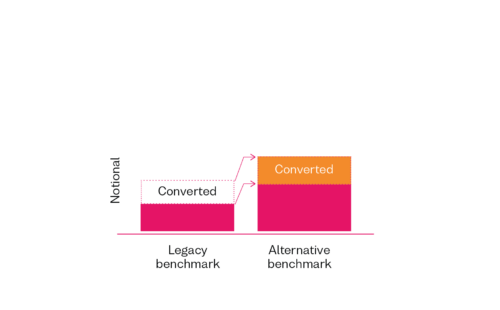

…Converting the remainder.

Convert remaining legacy benchmark swap exposure to the alternative benchmark.

- Remaining legacy benchmark swap exposure that cannot be compressed, through terminating trades or amending their terms, can be converted to the new benchmark through the introduction of risk replacement trades in the alternative reference rate, as part of regular triReduce compression cycles.

- Each party sets constraints on outright risk, as well as the basis risk between various benchmark tenors and alternative benchmarks, providing each firm with certainty throughout the conversion process on their risk impact.

- Risk-based constraints allow each participant to control the amount of conversion taking place. Tighter limits will mean only termination of trades or amendment of terms take place, wider settings facilitate inclusion of risk replacement trades in a single cycle.

- Should alternative benchmark term rates become available, risk and basis tolerances can be applied to control conversion into any new alternative rates.

Key Features

- Proactively compresses legacy benchmark trades and converts the remainder to the alternative RFR

- A single unified process

- Applicable to all IBORS and CCPs

- Deep liquidity pool, proven process and established connectivity to CCPs and market infrastructure providers

- Participants retain control of their market risk

If you are a market participant with cleared swaps, you are eligible. Contact info@osttra.com to find out more.