The introduction of agency clearing models, driven by the UST Clearing Mandate, necessitates a change to existing pre-trade processes and post-trade workflows. While existing market infrastructure supports a sponsored clearing model, changes will be essential to facilitate the required OTC style clearing workflows. OSTTRA’s established suite of services addresses these needs by providing a robust framework, capable of reliably supporting all required workflows.

The cleared repo environment is incorporating lessons learnt from a combination of bilateral repo and clearing for OTC derivatives. Existing bilateral repo platforms and processes are being adapted for clearing including defining the entities responsible for submitting trades to a central counterparty (CCP). While US cleared repo regulations are different from those governing OTC derivatives, market participants require comparable services in order to be operationally efficient in their transactions. This holds true globally, where non-mandatory cleared repo is growing in popularity, driven by dealer and client needs.

The introduction of agency clearing in the repo markets shares similarities with futures and OTC derivatives clearing. This model, similar to that in OTC, underscores the critical need to confirm that counterparties possess the necessary funds for a trade. This is particularly vital when clients utilise Clearing Brokers who haven’t agreed on the trade’s economics, but are nonetheless accountable for related clearing processes, such as remitting margin to the CCP.

Proactive solution development

OSTTRA is proactively addressing these evolving market demands with the introduction of two key services: OSTTRA MarkitWire for Repo and OSTTRA LimitHub for US Treasuries.

Building upon its well-established OTC derivatives service within the same application, OSTTRA MarkitWire for Repo functions as a sophisticated middleware solution. This service provides real-time trade affirmation and confirmation capabilities that span the entire lifecycle of a repo transaction.

Looking ahead, OSTTRA MarkitWire for Repo will be further enhanced to support seamless trade submission to a range of CCP’s and provide comprehensive capture of clearing status information. This expansion initiative reflects OSTTRA’s consistent approach across all asset classes, emphasising the fundamental importance of data standardisation and streamlined workflow processes. By actively promoting industry-wide consistency and best practices in market operations, OSTTRA MarkitWire aims to significantly streamline and accelerate both the initial trade confirmation processes and the subsequent management of lifecycle events, ultimately fostering greater efficiency and reducing operational risk within the financial marketplace.

OSTTRA LimitHub for US Treasuries, an extension to the OTC derivatives service, will leverage the success of the established OTC derivatives counterpart. Unlike middleware, it provides Clearing Brokers with a crucial perspective on their exposure, both before and after trades, verifying client limits. This venue and middleware-agnostic solution offers clients flexibility in their trading and submission processes for limit checking.

OSTTRA LimitHub for OTC derivatives is already a central cornerstone of the clearing ecosystem, used by 17 Futures Clearing Merchants (FCMs) for both pretrade and post-trade limit checks.

FCM insights on the value of limit checks

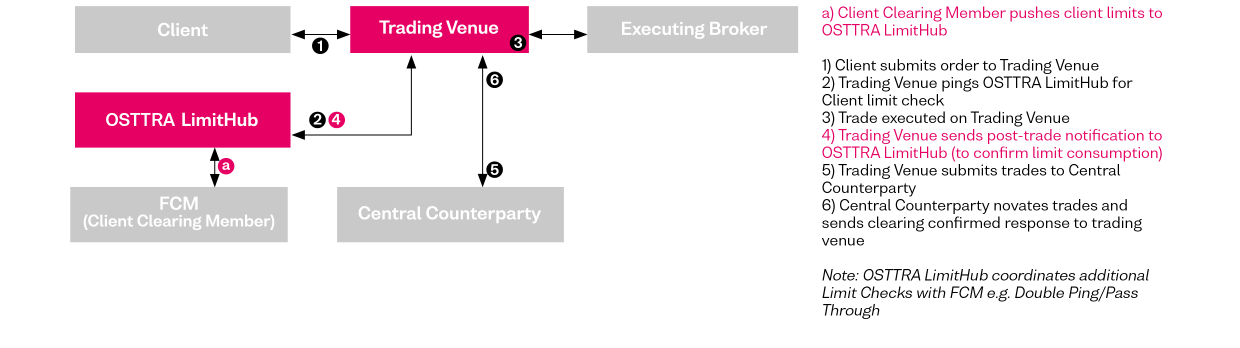

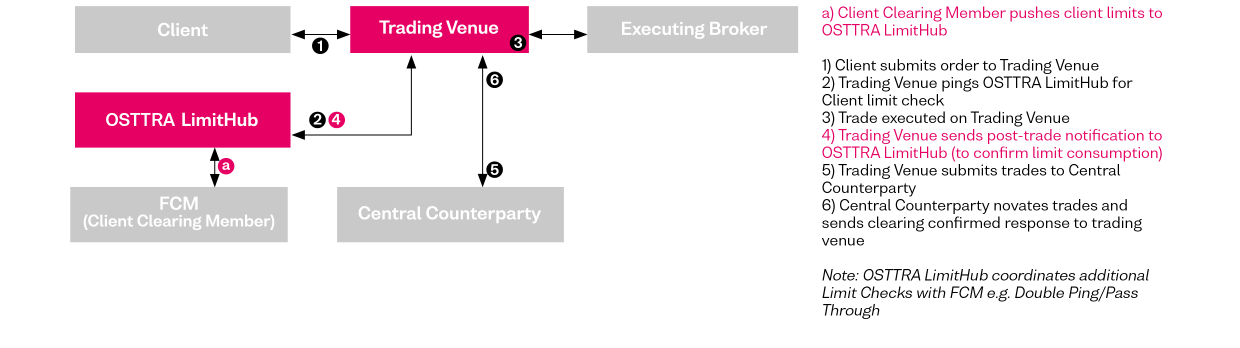

Feedback from FCMs highlights the indispensable role of limit checks in the successful implementation of agency clearing models. The OSTTRA LimitHub solution offers diverse models to accommodate various underlying activities and product types. For electronic venues, it supports both a Ping model, where orders are routed to OSTTRA LimitHub for verification and an approval or rejection message is returned based on limits set by the FCM (Exhibit 1), and a Push model.

Exhibit 1 – Request for Quote (RFQ) Trading Venues

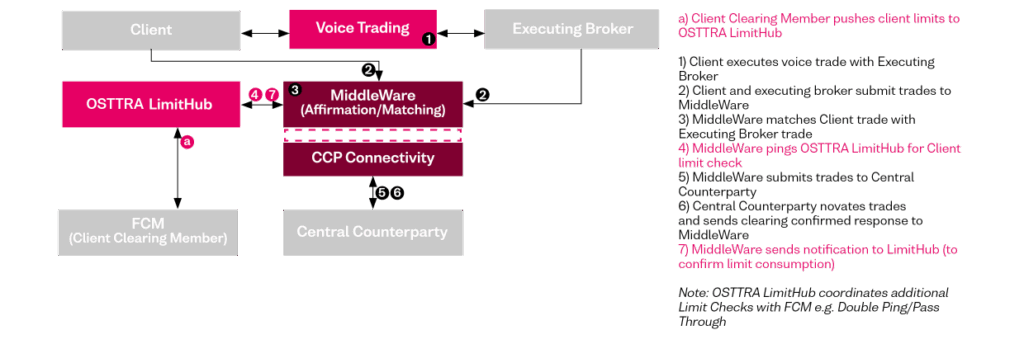

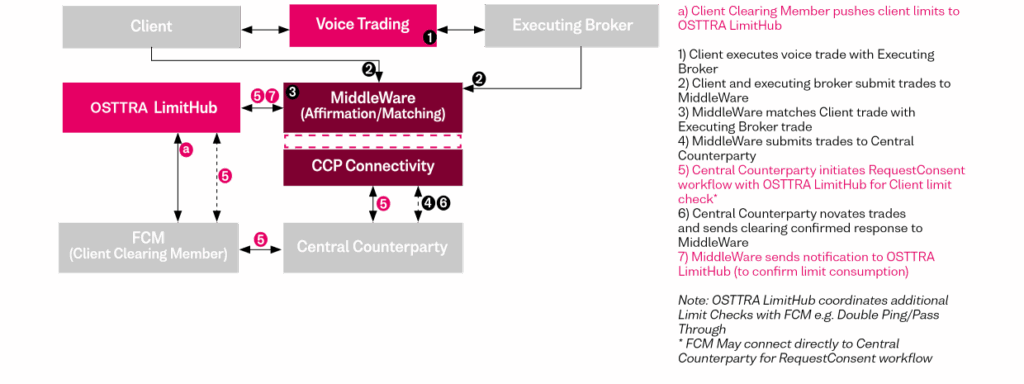

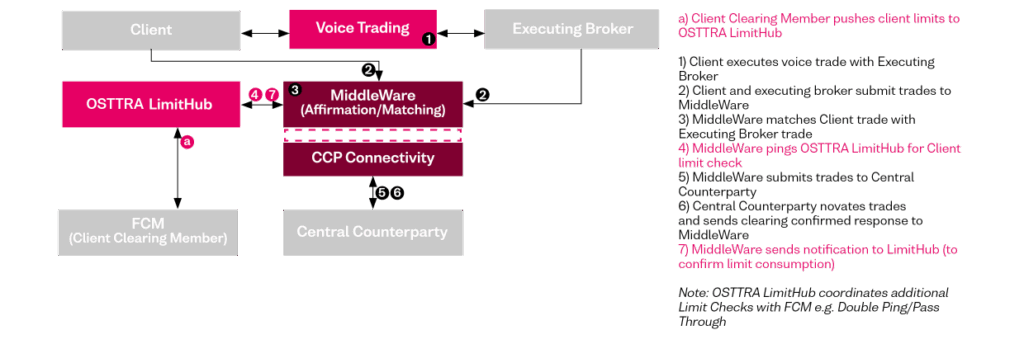

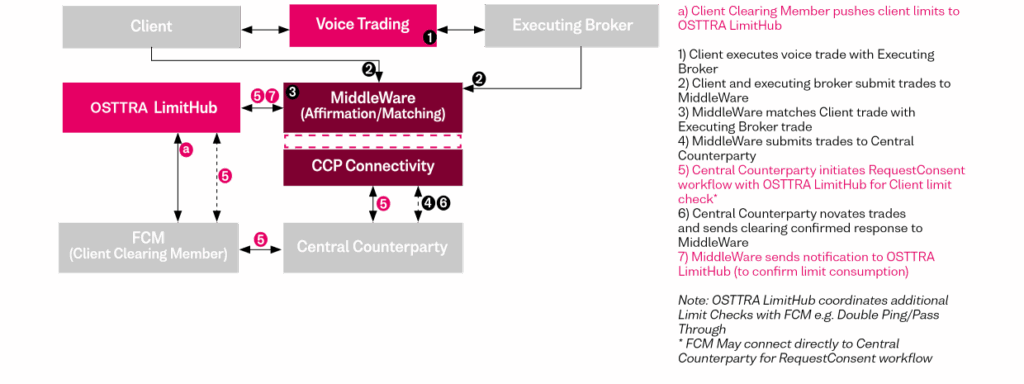

In the Push model, particularly where a venue operates a Central Limit Order Book (CLOB), OSTTRA LimitHub proactively pushes limits to the venue for local storage, ensuring minimal latency. Furthermore, the service will support offvenue executed transactions through post trade pre-cleared workflows, enabling middleware to connect directly for limit checks (Exhibit 2) or CCPs to perform request consent workflows with clearing brokers (Exhibit 3). OSTTRA LimitHub for US Treasuries is currently in development with UAT access planned for completion by the end of summer 2025. Rollout is expected by early 2026, at which point client onboarding will start. The product will encompass both cash and repo transactions under the US Treasury clearing mandate. Although the mandate has been delayed until June 2027, industry participants are unified in their commitment to proactive preparation.

Exhibit 2 – Middleware performs FCM request consent

Exhibit 3 – CCP performs FCM request consent

A unified view

Together, OSTTRA MarkitWire for Repo and OSTTRA LimitHub will provide the following capabilities:

OSTTRA MarkitWire for Repo:

- Cleared and uncleared repo support

- Trade affirmation and confirmation

- Lifecycle event management

- OSTTRA LimitHub connectivity

- Clearing submission and status view

OSTTRA LimitHub for US Treasuries & Repo:

- Pre-trade limit monitoring and management

- What-if credit checks

- Bunched order allocations

- Post-trade limit monitoring and management

To address anticipated fragmentation within the repo market (non-cleared and cleared including sponsored and agency), OSTTRA MarkitWire Repo and LimitHub offer services that acknowledge the wider market’s specific characteristics. These services will provide users with a comprehensive, unified view of all orders, trades, and clearing statuses across their entire network, encompassing both bilateral and CCP-cleared transactions. By integrating diverse data sources, firms gain a holistic perspective on activity involving clients, counterparties, and clearing houses. Recognising that no single service meets all client needs, the true value lies in the synergy of these integrated applications.

While central clearing of US Treasury repo has been in place for many years, the evolution of different clearing models remains an ongoing process. Rules and accounting treatments that will govern these models are in the final stages of approval and are expected to significantly shape market participant behaviour and infrastructure development.

As the industry adopts services that were initially developed for bilateral repo and OTC derivatives, the question remains whether the cleared repo market will also come to look like the cleared OTC derivatives market. Such convergence could present a range of new product opportunities that drive standardisation in both trading and post-trade processes. One potential outcome is greater operational efficiency which alleviates burdens for dealers and clients. This may represent a positive, albeit unintended, consequence of the new regulation.

Robust middleware and limit checking functionalities are essential for the success of agency models in global government bond repo markets. Whether mandated for clearing in the US or voluntarily cleared elsewhere, these services ensure strong operational integrity and risk management. Their effectiveness will be the ultimate measure of success in this rapidly developing area.

For more information, contact info@osttra.com