Traditionally, the back office has lagged behind the front office in technological advancements, hindering efficiency and accuracy in cash flow management. It’s time to shift gears and unleash the full potential of automation, regardless of asset class or payment type.

In December 2024, Philippe Lintern, the head of the Bank of England’s FX division, compared front office staff using the most advanced technology to Formula One teams, while noting that peers in the back office were left struggling to match the pace on their “rusty old bicycles.” An area where this rings particularly true is the $667 trillion global derivatives space, where cash flow management remains heavily manual, relying on humans, emails and even fax machines, despite the fast-paced world of trading pushing ever increasing volumes through this strained back office infrastructure.

It doesn’t have to be like this. As the dust settles from the all-consuming rush to T+1 settlement, resources can be re-focused on tackling some of the stubborn pockets of manual process that persist in the back office – and with the twin goals of improving both operational and capital efficiency, cash flow management is emerging as a priority.

“Last year we started to see a lot more focus on transparency and automation in post-trade interactions between counterparties, including those processes where custodians are involved, such as cash flow payments,” said Tom Woolfenden, Director, Product Design, OSTTRA. “However, so much manual coordination remains to agree and settle these cash flows.” This has been highlighted recently by the Financial Markets Standards Board in their final standard for sharing of Settlement Instructions, and updated guidance also issued in the Global Foreign Exchange Committee’s revised FX Global Code, such as Principle 44, which states that “Market Participants are encouraged to implement straight-through automatic transmission of trade data from their front office systems to their operations systems”, by means of secure interfaces where the transmitted trade data cannot be changed or deleted during transmission.

Cash flow management itself isn’t a complicated concept: At its core, it’s about making regular payments to the other parties involved in your trades, based on the underlying contract terms and up-to-date valuations.

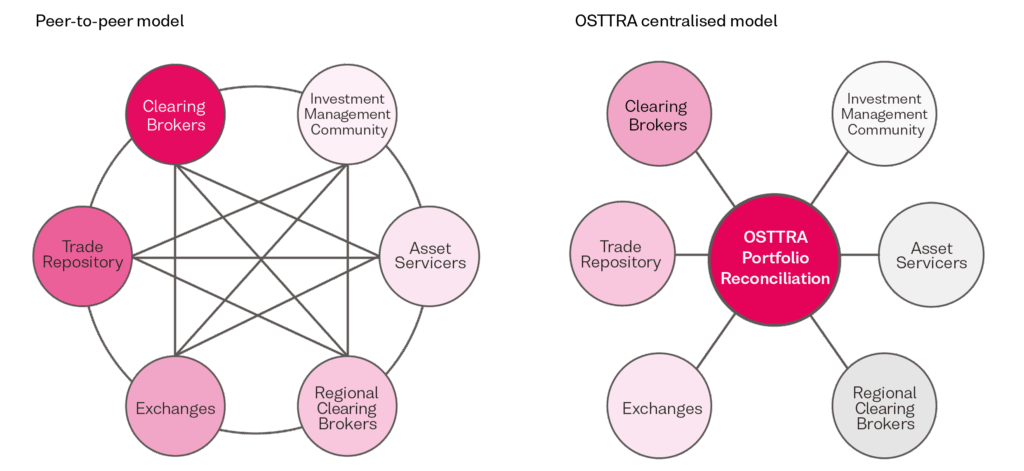

However, things get incredibly complex when you consider the scale of the market. A large financial institution might handle hundreds of thousands of these trades and their associated cash flows every month. This volume alone makes it difficult to track who owes what to whom. The problem is compounded by the fact that different participants use different data standards, calculation methods, market data sources, and messaging formats. This lack of standardisation can make it extremely challenging to even figure out which specific trade back-office staff are discussing in their emails, or which trade is causing a discrepancy.

“An absolute worst-case scenario is that you’re expecting to receive a cash flow from an open trade, and you have your designs on how to use that money, but your counterparty doesn’t even have an idea that there is an obligation to you”, Woolfenden adds.

Interest rate swaps, equity swaps and portfolio swaps are prime examples of the products where manual cash flow management leads to errors and operational inefficiencies. Take equity swaps for example: Cash flow management for these contracts involves the ongoing payments of the swap for the duration of the trade, as well as the underlying dividends and accruals, all of which need to be calculated, agreed on and then settled, which is where the uncertainty and misalignment comes in.

“We often see market participants taking agreed cash flow information offline, emailing, or even faxing it to their custodian, creating an inefficient communications chain to complete the payment and settlement process,” Woolfenden said.

As settlement times are expected to continue to shorten globally, untangling the confusion will quickly become even more important. Cash flow inefficiencies also prevent liquidity optimisation, or the ability of the front office to deploy cash to generate profits – because the money is stuck in a back-office limbo until the disagreement is resolved.

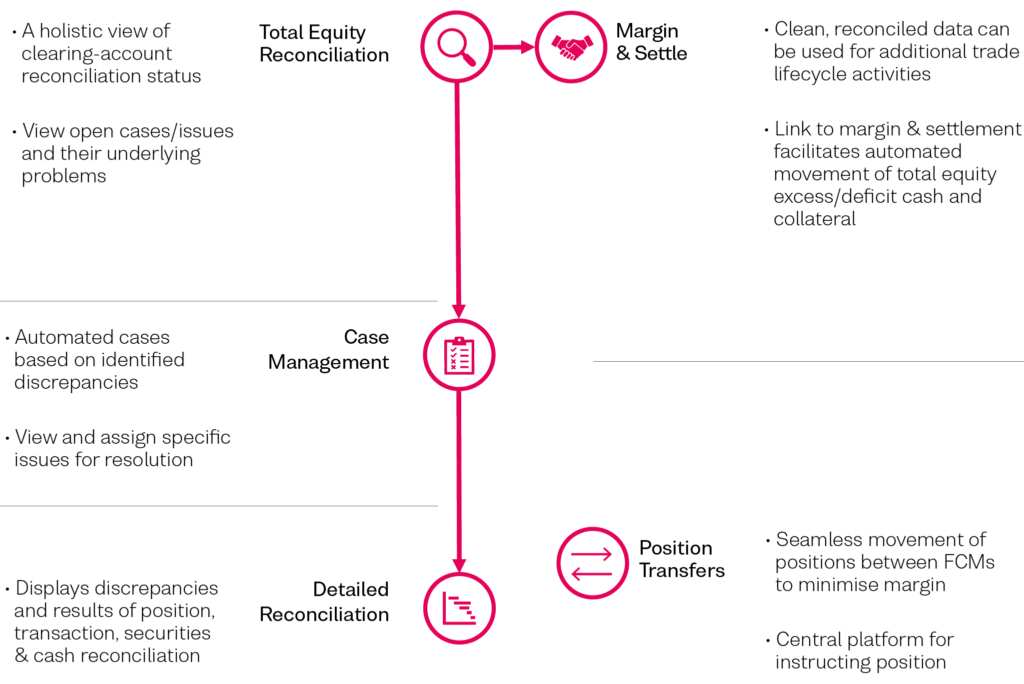

The most efficient way to resolve this conundrum is bringing transparency into the process for all sides and linking agreed trades with subsequent cash flows so that calculations can be made using consistent economics. OSTTRA Cash Flow Management is an established platform that helps streamline the cash-flow-processing challenge with a standard workflow and matching engine. With legal confirmations for many bilateral OTC trades readily available on OSTTRA MarkitWire and connected to the OSTTRA triResolve reconciliation engine, participants can have complete confidence that they share a common view of a transaction with their counterparties. An automated system that matches cash flows, as well as linking the underlying trades associated with them, removes the need to spend time figuring out who owes what and why: OSTTRA Cash Flow Management also notifies participants if they’re misaligned. It can also bilaterally net matched cash flows into an agreed, reduced number of payments whilst respecting settlement instructions.

“At OSTTRA, we are uniquely positioned to eliminate friction and inaccuracies in derivatives cash flows, thanks to our position at the centre of post-trade, from trade confirmation and processing through to portfolio reconciliation and collateral management, and all the opportunities for improving data standardisation that this brings. The end result is that we can seamlessly automate the entire process, including sending SWIFT settlement messages on behalf of our clients. The settling bank, typically the custodian, can receive an instruction to do the settlement just one minute after the cash flow is matched, removing the all too common merry-go-round of email, phone and fax communication and bringing greater transparency on a real-time basis,” Woolfenden said.

Once the whole lifecycle is automated, conducted in real-time and in a way that’s transparent to parties, calculations can be done on the same basis, payments can be netted and settlement becomes a matter of a simple instruction to the custodian – as easy as riding a bike! To learn more about OSTTRA for Cash Flow Management, please visit osttra.com/cashflow