Looking ahead at the calendar of global events, 2024 is shaping up to be quite a big year. Elections in more than 20 countries, not least in the UK, US & India; ongoing geopolitical tensions and war; plus on the sporting front, the return of the Olympics to Paris for first time in 100 years. With all that going on, the world of collateral management might seem a little more prosaic!

Neil Murphy, Business Manager at OSTTRA considers the key focus areas for Collateral Managers in 2024.

Regulation

Eight years since the introduction of mandatory requirements for non-cleared derivatives (Uncleared Margin Rules, or ‘UMR’), firms both big and small face continued efforts to navigate UMR impacts, particularly related to the monitoring of entities not yet in-scope and IM documentation. In addition, 2024 heralds the introduction of additional UMR requirements in new jurisdictions (including Mexico and India), bringing firms into scope not only in these countries, but also potentially impacting their counterparts around the world. To assess the impact, firms must adhere to AANA (Average Aggregated Notional Amount) calculation windows (March – May) to evaluate newly impacted entities and liaise with counterparties to understand the corresponding impact. Further, this may create an on-going requirement for new legal documentation and custody arrangements.

FINRA 4210 rules for margining of TBA trades have been repeatedly delayed since 2016, but firms finally now have a May 2024 deadline for which to prepare. And while the introduction of margin requirements on these trades may seem like just another asset class, the rules contain a unique set of characteristics, including the potential to waive margin exchange in lieu of additional capital charges.

In terms of transaction reporting, 2024 will be a crucial year marked by noteworthy changes across several jurisdictions (EU/UK EMIR Refit; CFTC Rewrite; JFSA Rewrite; ASIC/MAS updates). Given the global aspect of these changes, most OTC derivatives users will find themselves effected, and priority should be given to understanding new requirements and necessary changes to both reporting & validation. Key changes require reporting of new fields (taking the number to more than 200!); additional standardisation via adoption of the ISO 20022 standard; the introduction of Unique Product Identifiers and a move away from file upload to use of XML. For firms who delegate reporting, while the rules don’t alter the obligation, the scope of the upcoming changes means firms should seek to evaluate that their reporting party is able to comply, given that they remain liable for reporting.

Process improvements

Winston Churchill may not be the obvious guru for Collateral Managers, however his observation that ‘to improve is to change; to be perfect is to change often’ sounds like sage advice. Whether the driver for change is regulation; organic business growth or cost savings, 2024 should see firms focus their attention on improving existing operational processes, as well as laying the foundation to support new initiatives.

“To improve is to change; to be perfect is to change often”

Winston Churchill

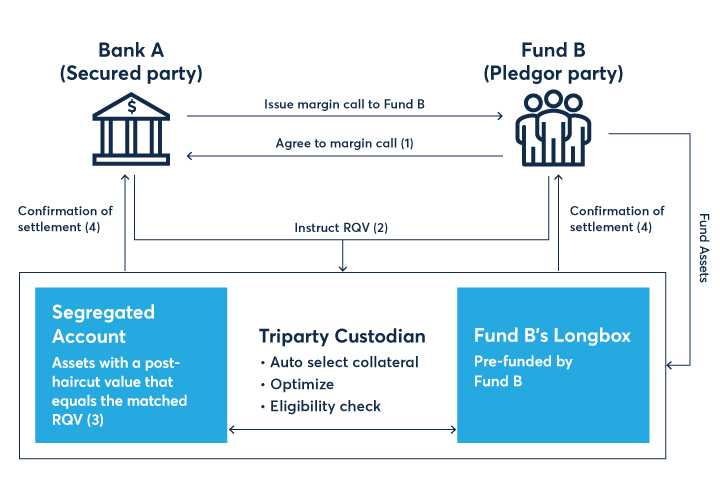

While UMR has been a key driver of increased workloads in recent years, both in terms of project delivery and creation of an operational framework, it is likely to continue to occupy the minds, and time, of Collateral Managers. For those firms who have so far taken the ‘lighter’ route of IM monitoring, they may find themselves approaching IM thresholds, and hence may need to improve operational capacity to manage the margining, settlement and reconciliation of Initial Margin. And even those more mature firms with robust IM capacity may find themselves stretched by additional volumes, necessitating further investment in workflow automation and triparty connectivity. For firms who chose to reduce the impact of UMR by outsourcing the day-to-day management of IM requirements, many are now reviewing that and determining whether the time is right to bring in-house.

Recognising the ongoing UMR challenge, a recent BCBS-IOSCO paper recommended that ‘firms should ensure that existing UMR frameworks expand as existing Initial Margin exposure increases, potentially forcing firms to move from a low effort ‘monitoring’ approach to a more resource intense (and costly) exchange of Initial Margin’.

“firms should ensure that existing UMR frameworks expand as existing Initial Margin exposure increases, potentially forcing firms to move from a low effort ‘monitoring’ approach to a more resource intense (and costly) exchange of Initial Margin”

BCBS-IOSCO

The same paper also proposed recommendations to ‘encourage more widespread automation and standardisation of the margining operational processes and highlight the need for proper operational risk management’. For many, such improvements should focus on improved use of electronic messaging for margin call exchange, thus reducing time and efforts, plus improving the end to process, particularly around collateral settlement and dispute resolution.

While much of the market focus has been on improvements for OTC margining, firms should now leverage these same tools to bring efficiencies across Cleared, Repo and ETD products. Case in point is exchange traded products, with more than 130 billion contracts traded in 2023, doubling in just two years. A focus on adoption of industry standards (systems; protocols; processes etc.), can help facilitate synergies across products, further allowing firms to manage risks centrally and reduce overall costs.

Technology upgrade

Improved technology is central to helping firms meet their requirements around regulatory change and operational improvements. While some firms used UMR as an opportunity for system upgrade and renewal, others took a ‘wait and see’ approach. Given the current trend for increased automation, a potential need for ongoing regulatory tweaks – combined with moves to consolidate margin processing onto a single platform – and that previous investment is now looking like money well spent.

Key areas of focus are leverage of cloud capability and shared use of network infrastructures to reduce cost and quickly help firms achieve industry best-practice. Infrastructure improvements across the collateral lifecycle can help firms leverage automation to meet increasing volumes and operate within shorter time windows.

Optimisation

An impact of regulation can be to increase both capital and liquidity costs. While rising interest rates make the use of cash collateral increasingly more expensive. The net impact is that more and more firms are considering how optimisation can be used to combat these increases.

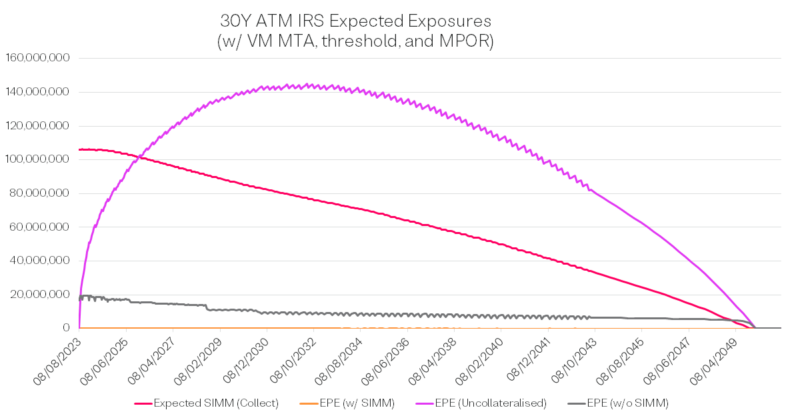

The goal of optimisation may be different for each organisation, so firms need to work across Risk, Front Office and Operations to determine the most appropriate optimisation objectives for their firm. Some may choose to focus on minimising capital costs (SA-CCR; RWA etc), while others prioritise operational efficiency or reduced funding cost (SIMM™; CCP IM etc.) – while for others a multi-function approach may be necessary. Pre-trade optimisation capabilities may be used to help firms select the optimal trading venue or counterparty, while a post-trade strategy may assist firms to offset risk through compression or offsetting trades, or lower funding cost by selection of cheaper collateral assets.

Capital and liquidity optimisation require complex processing and are often applied in a real-time environment hence some firms may determine the pay-off is not yet sufficient. This doesn’t mean they should disregard optimisation entirely. Instead they should focus on operational optimisation, improving processes to minimise manual efforts and deliver the highest levels of STP.

Summary

How firms balance the above challenges will vary based on their individual starting point; budget; Front Office/regulatory focus and technology capability. OSTTRA is helping firms address these challenges every day. In 2023 we saw record adoption across new asset classes, as firms focus on centralised processing for Cleared, Repo and ETD products. Similarly, we see more and more firms embracing cloud and automation to manage their end-to-end collateral business, while the optimisation conundrum continues to drive client conversations.

Given this year is also marked by the first US-crewed mission to the moon in more than 50 years, perhaps the question for Collateral Managers is, ‘will they take a small step, or a giant leap in 2024’?