While headline ETD volumes have receded from last year’s highs, we see many firms using this period as a strategic opportunity to refine their infrastructure. With the industry pushing to meet the 30/30/30 standard for trade timeliness, now is a good time to focus on the automation that reduces risk and prepares your listed derivatives operations for the next wave of growth.

In this newsletter, we focus on the tools that can help you do just that. We will cover:

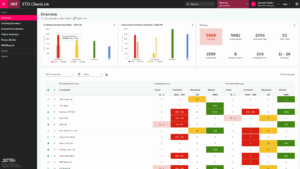

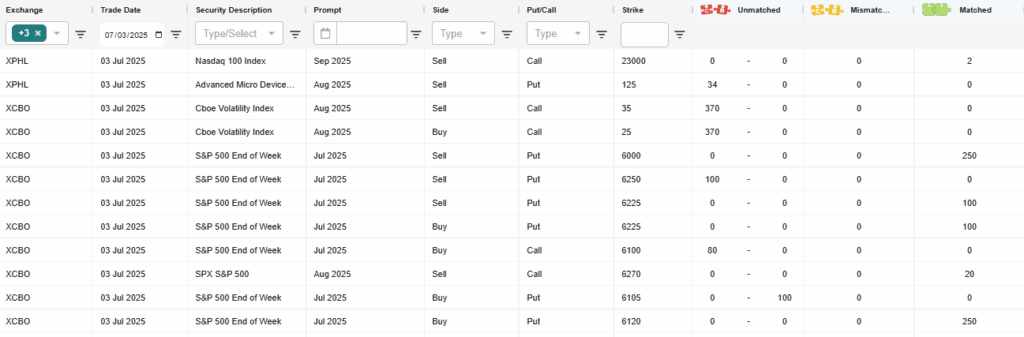

- The refreshed user experience of our ClientLink UI.

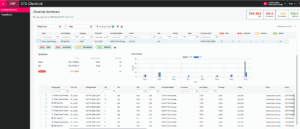

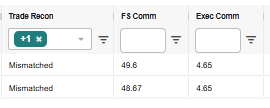

- Feature focus on to our commission and fees capabilities.

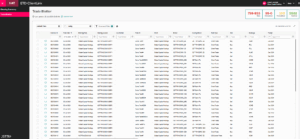

- Practical steps for using Order ID matching to meet T+0 goals.

- A look at our expanded support for US Listed Options.

We hope these updates help to provide a clear path to a resilient and efficient 2025.