OSTTRA for ETDs provides a comprehensive solution that streamlines the entire trade lifecycle for Exchange Traded Derivatives, from executions and allocations to reconciliation, position transfers, and margin automation.

Gain efficiency through a centralised global service where all your counterparties access a shared view. This enables seamless reconciliation and dispute resolution across bilateral/cleared OTC derivatives, Repo, collateral, securities lending, TBA, and exchange traded derivatives (ETDs).

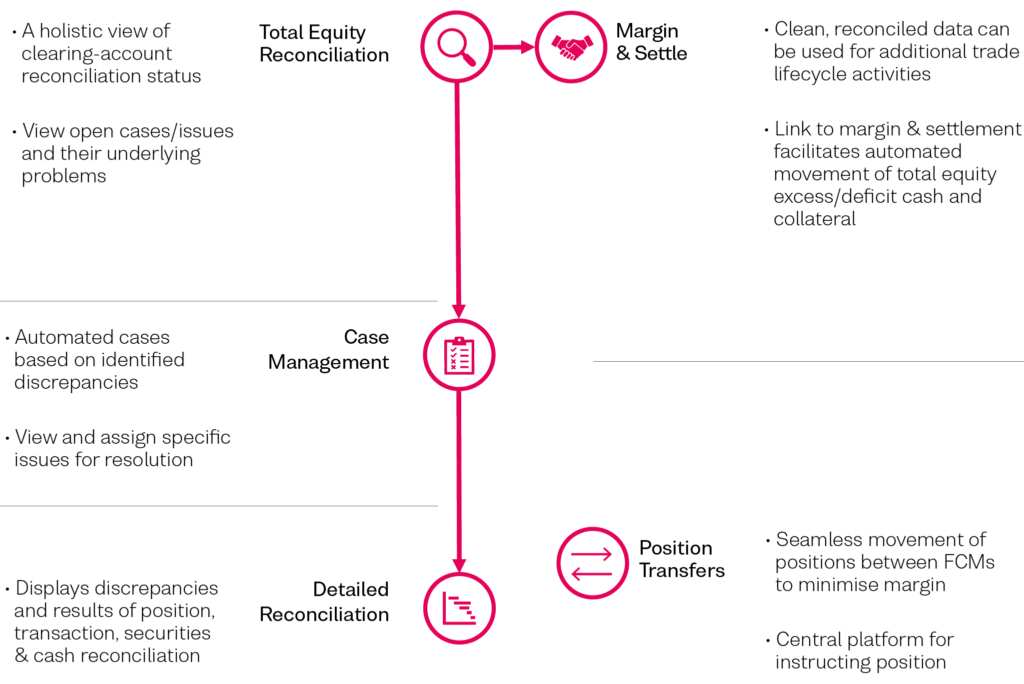

The path to an enhanced total equity reconciliation

A complete solution:

OSTTRA triResolve provides a comprehensive, fully managed service for all your ETD post-trade needs. Simplifying processes from trade capture through to margin settlement, our platform actively manages:

- Connectivity to the FCMs across the network

- Daily data collection and management allowing timely reconciliation

- Automated discrepancy identification and resolution workflow

Key benefits

- Complete Portfolio View: Get a comprehensive understanding of your entire ETD portfolio.

- Enhanced Insights: Our automated analytics deliver the clear, bilateral understanding you need.

- Holistic Reconciliation Management: Gain a complete view of your clearing-account reconciliation status, with automated case generation for identified discrepancies and clear display of position, transaction, securities, and cash reconciliation results.

- Independent Margin Validation: Independently validate all your ETD IM and VM margin calls through our strategic FIS partnership.

- Transparent Margin Insights: Track margin evolution and receive simplified IM calculation breakdowns.

- Simplified audits & data management: We provide comprehensive reports to help meet audit requirements, while seamlessly handling your data inflow.

- Web-based: No installation required; swift onboarding.

How it works:

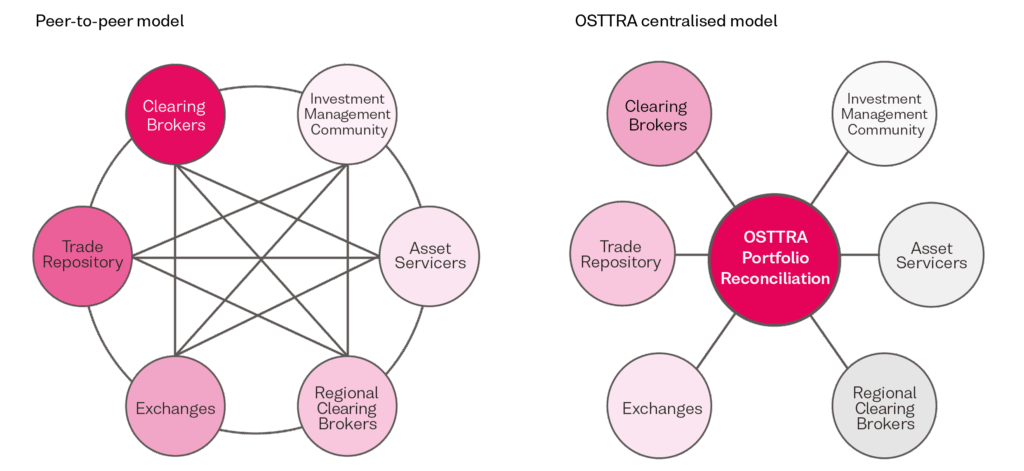

Reduce complexity with a single point of integration with all your counterparties: our centralised service model gives you and your counterparties the same view to work together and resolve any differences.

Our automated ETD solution supports reconciliation, dispute management, margin and settlement, all in one place, giving you a single comprehensive view of your clearing accounts. Instantly identify discrepancies, review open cases and track outstanding exceptions, with easy drill-down capabilities to understand underlying problems. We ensure data consistency, conduct thorough position and trade reconciliations, and offer a flexible case management system.

OSTTRA effortlessly scales to your operational volume. For firms managing significant volumes and multiple clearing brokers, we provide an automated reconciliation and sophisticated workflow automation, including proof of cash.

Alleviate operational burdens, improve efficiency, gain critical transparency, and achieve operational excellence with OSTTRA.