Regulatory IM collateral segregation and the choice of triparty versus third-party

While the need to calculate and post Initial Margin grabs the headlines, so to speak, in terms of priorities for firms looking to comply with uncleared margin rules (UMR), there are many other issues for firms to consider.

Not least is the requirement that Initial Margin (IM) is segregated in a bankruptcy remote account. Firms coming into scope and obliged to exchange IM, must work out HOW they will segregate collateral. The fact that many of these firms will be using non-cash collateral for the first time adds to the challenge.

There are two segregation structures in play today: triparty and third-party, and there are multiple factors to consider before deciding what’s best for a firm. This choice impacts the new legal documentation to be put in place, including clauses in the Account Control Agreement with each custodian, as well as new ISDA Credit Support documentation with each counterparty. It also has direct consequences on a firm’s operational model.

For many firms coming into scope in phase 5/6 of the rules, the triparty model is an entirely new process given the wider reliance on the traditional custody model. For those not currently utilizing a segregation model for collateral held as Variation Margin (VM),this may mean a steep learning curve, and you must weigh the relative cost vs. operational process requirements of each model.

Tri-Party

Triparty structures are generally more expensive than third party structures. This is because in the triparty model the custodian provides a broader range of services, taking on more of the operational process on behalf of the client.

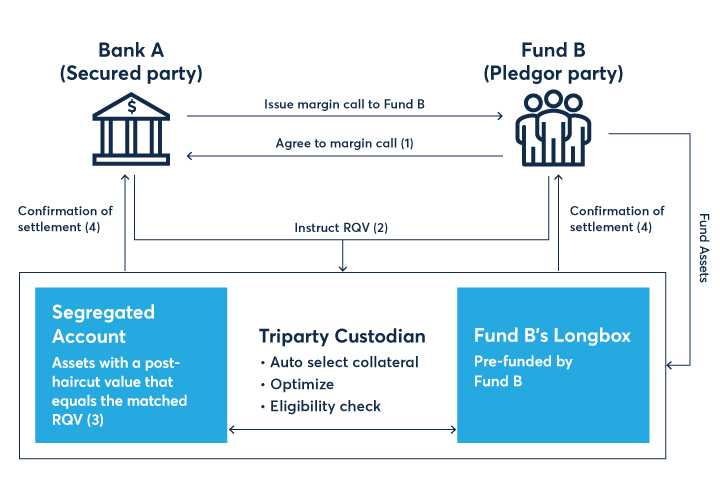

Clients must each maintain a ‘long box’ of potential collateral at the triparty custodian. Upon agreement of the IM margin call, each party must instruct the custodian of the RQV (required collateral balance). This contrasts with traditional VM settlement, where each party will also agree the collateral to be pledged before instructing the custodian.

Upon receipt of the RQV, the custodian will check the existing balance of the segregated account, look in the pledgor’s long box to see available securities and determine which securities in the long box are eligible to be pledged for this agreement, before calculating how much collateral must be moved to get to the required balance.

It will then move/settle the appropriate collateral to the segregated account. In this case, the triparty custodian selects the asset to pledge, applies a haircut and calculates the collateral value. It may also provide optimization services to provide the best use of a client’s long box, as well as perform collateral substitutions on the client’s behalf.

Third-Party

Third-party structures are generally less expensive because they require clients to ‘own’ more of the operational workflow steps involved in collateral selection and settlement. Under the third-party structure, firms and their counterparties must first agree the IM call amount and then the collateral to be pledged, before instructing settlement to the custodian.

In other words, when firms use a third-party custodian they are responsible for calculating the amount of additional collateral required, selecting an asset, verifying collateral eligibility, applying haircuts, valuing collateral, performing optimization, managing substitutions and instructing settlement to the custodian. This is the same process that would be used to post securities if the collateral was not segregated.

What to do?

If you are using a third-party structure today for segregation of Variation Margin or Independent Amount, you likely already have a process in place to support non-cash collateral. Your experience with these processes, as well as your relationship(s) with existing custodian(s), may make a third-party model a natural choice. However, if you are only using cash collateral today, the additional operational requirements brought about to segregate non-cash collateral may seem unattainable in a short timeframe. Firms need to clearly understand each model and assess not only their operational capacity, but systems capability too. The challenge of meeting an entirely new collateral segregation process using legacy technology – which was probably built long before the requirement to exchange Initial Margin evolved – must not be overlooked.

To learn more about Collateral Management, click here or contact us at info@osttra.com.