In the second of a two-part series, Michael Wilshere, Commercial Head of FX and Rates Trade Processing at OSTTRA, discusses the changing shape of post-trade and how market demand is shaping future innovation on OSTTRA MarkitWire and beyond

Like many parts of the financial services ecosystem, the early mechanics of post-trade were characterised by siloed services, manual processes and clunky technology. Faxed trade records and couriered derivatives confirmations were commonplace. Today, however, the post-trade landscape looks very different, driven by the push and pull of regulatory change and client demand.

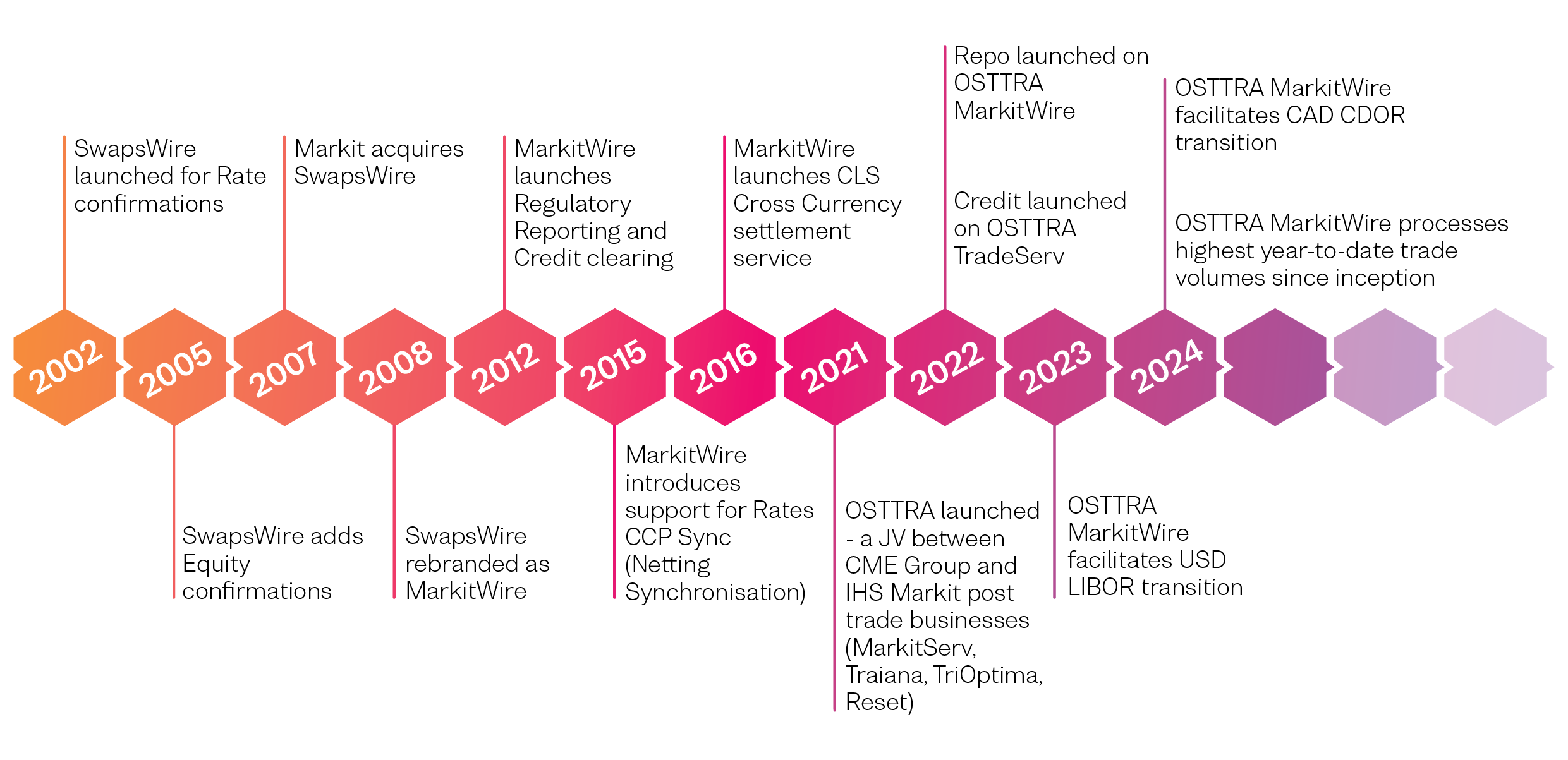

OSTTRA has played a key role in driving transformation and helping firms adapt. Its offerings span multiple asset classes and steps in the post-trade lifecycle – from trade capture and confirmation, through portfolio reconciliation and margin management, to risk and capital optimisation. At the heart of the firm’s network is the OSTTRA MarkitWire trade processing platform, which has been evolving continuously for more than 25 years to streamline and automate rates and equity derivatives trade workflows.

Michael Wilshere outlines some of the key innovations that are shaping the future of post-trade processing.

As a starting point, could you outline some of the key trends you’re seeing in the over-the-counter (OTC) derivatives space today, and where you’re seeing growth in demand for post-trade services?

If we look at the more established markets, customers in the UK, Europe and the US are still balancing regulatory compliance with the drive for frictionless trade, especially given current market volatility arising from elections, macroeconomics and trade policies. They’re looking to providers like us to resolve breaks, disputes or connectivity issues.

We’re addressing this by introducing functionality in the cleared and non-cleared spaces. For example, packaged trade functionality in clearing ensures all trade legs are processed (cleared or rejected) simultaneously. And, in the non-cleared space, we are focusing on matching accuracies, such as where breaks occur in date conventions or where there are different accounting conventions on the trade.

In emerging markets, we’re seeing different trends. Clients there are looking to move into the centralised networks we provide to benefit from our products, workflows and functionality. Additionally, they require nuanced local market solutions, such as moving their paper workflows to electronic templates. We’ve introduced currency support in the Middle East – Saudi Arabia and the United Arab Emirates – and, this year, we’re working with customers in Latin America to introduce inflation-based swaps in Chile. Advocating for the move from manual to electronic processes remains a key theme for this segment.

More broadly, we’re partnering with upstream venues, downstream clearing houses and regulatory jurisdictions to ensure customers benefit from efficient end-to-end workflows.

From the Basel Committee on Banking Supervision reform to the interbank offered rate (IBOR) transition, regulatory change has played a key factor in the evolution of post-trade services. Which initiatives do you expect to exert the greatest influence over post-trade requirements in the next five years?

The IBOR transition and Basel benchmark reform have driven much of the activity over the past six or seven years. This has brought new risk-free rates into the post-trade landscape, impacting bilateral matching, confirmations and cleared workflows. OSTTRA MarkitWire plays a crucial role by integrating updates from central clearing parties during these transitions and seamlessly feeding new trades to customer risk

systems.

That activity peaked in 2023 with the US dollar Libor migration to the secured overnight financing rate (SOFR), but the momentum continued last year with Canada’s migration to the new Canadian overnight repo rate average (CORRA), as well as Mexico’s switch to the TIIE de Fondeo rate.

These reforms are progressing in established and newer markets, with ongoing medium-term activity. This year, for instance, we have had clearing house activity and transition events in Israel, and there is active interest from local markets such as Denmark, the Czech Republic and South Africa. Over the past five years, OSTTRA has facilitated the move to risk-free rates in around 15 markets, while OSTTRA MarkitWire supports more than 30 currencies and regional markets. There’s a runway for further activity, helping clients with those transitions.

One other item worth highlighting – which has driven a lot of activity in the past 12 months – is enhancing transparency around regulatory reporting. In the first half of 2024, we assisted customers with supporting unique product identifier processing for regulatory reporting, particularly in North America for the Commodity Futures Trading Commission and Canada.

Subsequently, we supported numerous customers with regulatory rewrites, adding new fields and tags for European reporting – the UK Financial Conduct Authority and the European Securities and Markets Authority. And, in late 2024, Asian authorities – the Australian Securities and Investments Commission, as well as the Monetary Authority of Singapore. Again, that will continue in the short and medium term.

Even now, this focus on reporting clarity continues, with current work including updates to Canadian regulatory reporting requirements for several swap execution facilities.

What are the main challenges facing market participants in the current environment? And how has OSTTRA MarkitWire evolved to meet client needs in these areas?

Starting with the bilateral cross-currency space, we’ve certainly seen a lot of customers looking to move the matching and confirmations workflow closer to the settlement cycles. This is primarily driven by tighter settlement timing thresholds, the T+1 initiative and updates to the FX Global Code of Conduct. Our cross-currency connectivity service, which extends to settlement agencies and banks, has been expanding to meet this demand, and we’ve seen that underlying network grow significantly in recent years. The challenge is to bring matching and confirmations closer and more aligned with settlement, streamlining two workflows into one.

Beyond cross-currency swaps, swaptions are presenting increasing use cases. These are complicated products that can take some time to process. We’re introducing enhanced functionality and are working closely with leading investment firms and trading venues. The goal is to connect historically confirmed or matched options and provide this information back to the venue when these firms execute new transactions. Viewing these trades enables firms to flatten existing risk or strategically create new risk.

On the clearing side, there’s a strong emphasis on finding the best clearing models for the US Treasuries market, despite the extended deadline for clearing cross repo and cash instruments.

From OSTTRA’s standpoint, while it is not for us to dictate what types of models are adopted, we do want to provide valuable insights and awareness to customers as they transition to these new clearing workflows. This approach is informed by our experience assisting numerous market participants with the OTC swap clearing implementation under the Dodd-Frank Act approximately a decade ago.

We’re achieving this through contributions to industry working groups, speaking to trading venues, clearing brokers, clearing houses, and so on. In terms of solutions, our credit limit check service – OSTTRA LimitHub, already used by clients for interest rate and credit default swaps – offers significant potential value for the treasury clearing space.

“There’s a strong emphasis on finding the best clearing models for the US Treasuries market, despite the extended deadline for clearing cross repo and cash instruments.”

– Michael Wilshere, OSTTRA

A previous Risk.net article, From faxes to fintech, mentioned OSTTRA’s desire to collaborate with clients to build a future defined by “efficiency, innovation and connectivity”. Can you provide examples of where OSTTRA is delivering on this ambition?

Considering the volume of rates workflow that is cleared, we’re very much focused on our clearing network when it comes to connectivity, so I’ll start there.

Currently, we have connections to 12 central clearing counterparties, and we’re looking to enhance that through packaged clearing, which is being rolled out in conjunction with industry partners.

We’re also speaking to newer clearing houses to bring them into the network, giving clients more optionality. We signed a memorandum of understanding a few months ago with Muqassa in Saudi Arabia – our first clearing house in the Middle East – offering access and workflow solutions across emerging markets.

Further downstream, within our lifecycle events, we have a reconciliation tool called OSTTRA triResolve. When customers look at reconciliations, they are always referring back to the principal trade confirmation or trade match. That’s available through our trade processing services, within rates, on OSTTRA MarkitWire, so we have connected the reconciliation process to the platform. We’ve completed this with more than 150 customers – there’s a lot of demand – and we’ll continue to look for ways to make post-trade markets more efficient.

Post-trade services are sometimes viewed as an unavoidable cost to the bottom line. How can firms maximise value from their investments in this area?

I’d agree, but there are examples where I think we are providing a new narrative. A prime example is OSTTRA’s initiative in uncleared portfolio optimisation, specifically concerning FX processing and cross-currency swaps. Here, we’re leveraging multiple products within OSTTRA by connecting OSTTRA MarkitWire to downstream services for mark-to-market valuations and settlement processes. We’re taking clients on a journey from a ‘collateralised to market’ methodology to a more advanced ‘settled to market’ one. This approach will significantly enhance counterparty risk mitigation but will also help eliminate ‘in transit’ collateral costs. Work is under way to help define the mechanics, the rule book and the first set of client use cases.

Overall, this is an example of where we are introducing a new workflow and maximising value within the trade lifecycle, rather than it being an ‘unavoidable cost’. The journey effectively mimics some of the margin efficiencies typically seen at clearing houses but, critically, these benefits are achieved within the non-cleared space.

Huge volumes of data are processed across OSTTRA’s platforms and network. To what extent can participants access this information to support superior decision-making?

One of the more established offerings is the Material Economic Terms service. This provides US swaps dealers with files detailing the economic terms of a trade, which they are required to disclose to their counterparties. OSTTRA MarkitWire manages the template and legal confirmation, which we feed back via swap-dealer systems and their own websites, ensuring dealers meet these transparency obligations.

We also offer a compliance service that delivers crucial timing data across the lifecycle of a trade, covering stages such as when a trade is submitted, matched and sent for clearing. Customers can see their ‘bottlenecks’ or ‘delinquent’ trades compared with timing standards and thresholds introduced by US and European Union regulations – effectively, 10 minutes to process certain types of trades and 10 seconds for electronic trades.

One of our newer initiatives is the Operational Metrics service. Using the OSTTRA MarkitWire self-service tool, clients have access to in-depth data and analytics on their trades. The clients can see, for instance, how timely and efficient they were in processing swaption trades or linear and non-linear transactions. Clients are then able to drill down into different currency types, counterparties and products. The service is currently available across rates, credit and equity products across OSTTRA MarkitWire and TradeServ platforms.

A particularly valuable aspect of the Operational Metrics service is that, because we’re centralised and have a broad range of market players using the system, we can provide anonymised benchmarking against different peer groups. This directly addresses a common question we hear in customer discussions: how are we performing relative to our peers? The service provides users with this insight and flexibility, so a tier one bank can see how timely it is compared with the other Group of 14 banks, and whether it’s trending up or down.

What opportunities do artificial intelligence and other advanced technologies present for improvements in post-trade processes? Where are we likely to see the greatest benefit?

While we’re actively exploring use cases for different types of AI, we’ve already implemented impactful solutions using machine learning AI that are delivering tangible benefits today. A good example is our paper digitisation module within OSTTRA Trade Manager, which digitises PDF confirmations and enables customers to match the digitised version of the trades to their submission. We use machine learning AI to parse the economic fields of the paper confirmation and create a digital record of the trade, which is then automatically matched against the client’s submission.

It’s a product that is growing, both in terms of customer adoption and the extensive range of products supported. It currently supports more than 20 products across equities, commodities, credit and FX. Looking ahead, beyond this digitisation of the core economic terms, we’re seeing clients request additional use cases: for example, comparing legal language clauses through the lifecycle of the document. We believe there’s a considerable runway for this technological offering and are very enthusiastic about its future development.

What are your hopes and fears for the future of post-trade?

We highly value our excellent customer engagement, fostered through working groups, catch-ups and meetings, and are committed to maintaining this high level of dialogue. We want to hear about new use cases and where we can genuinely help our customers, all while maintaining their trust established through OSTTRA MarkitWire.

To provide an idea, last year we processed around $1.5 quadrillion in notional value, so there’s a lot of trust, history and good faith built up there. Our hope is to keep working closely with customers, continue delivering by building better functionality, making our systems more resilient and performant, and taking smart, incremental strides forward with the broader market.

Regarding fears, the inherent industry risks could lead some clients to consider fragmenting their workflows, perhaps for short-term gains or other motivations. However, we strongly encourage clients to recognise the enduring value of the broader network – particularly the robust, centralised and standardised nature of swaps – which has proven resilient through all market cycles. We believe continued collaboration is essential for driving innovation within the post-trade infrastructure.

This article was originally published on Risk.net