Following the LIBOR cessation events in CHF, EUR, GBP & JPY at the end of 2021, focus turned to managing down outstanding exposure to USD LIBOR in 2022. At the beginning of the year, the market appeared to take a deep breath and debrief on the positive outcomes of the conversion activities and fallback implementations, as well as planning for the areas that could be improved upon ahead of the upcoming cessations.

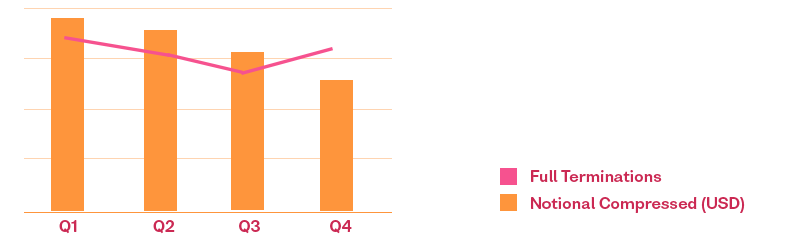

Outstanding USD-LIBOR exposures gradually declined through the year and we in turn saw quarterly declines through 2022 in notional terms.

However, we observed exposure in trade count terms materially tick up in Q4 through a combination of our continued calibration of the prioritisation given to legacy benchmarks, as well as bringing new participants into the network.

| Cleared USD LIBOR Terminations in 2022 |

|

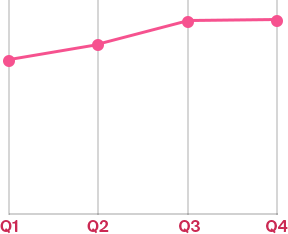

As market participants have geared towards proactive and iterative reduction of their legacy benchmark exposure, we have seen consistent quarter-on-quarter growth in the use of our OSTTRA triReduce benchmark conversion cycles, as well as the adoption of our most advanced methodologies for compression and conversion.

The charts below show how this usage has trended over the year, laying a great foundation for a big push this quarter in 2023.

| USD Benchmark Conversion Participation

|

Risk Replacement Trade Adoption

|

|

|

To discuss your benchmark conversion needs, contact info@osttra.com.