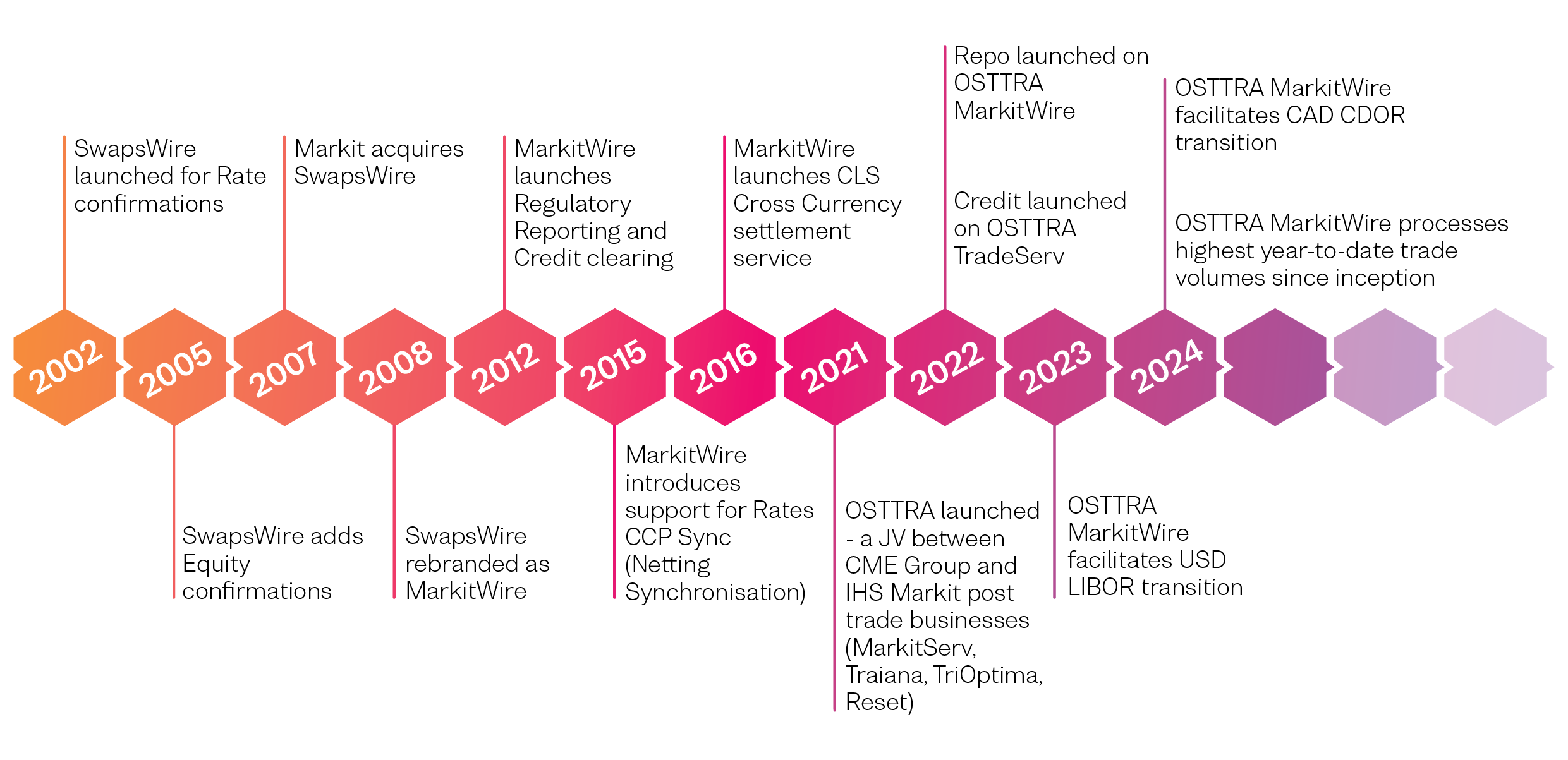

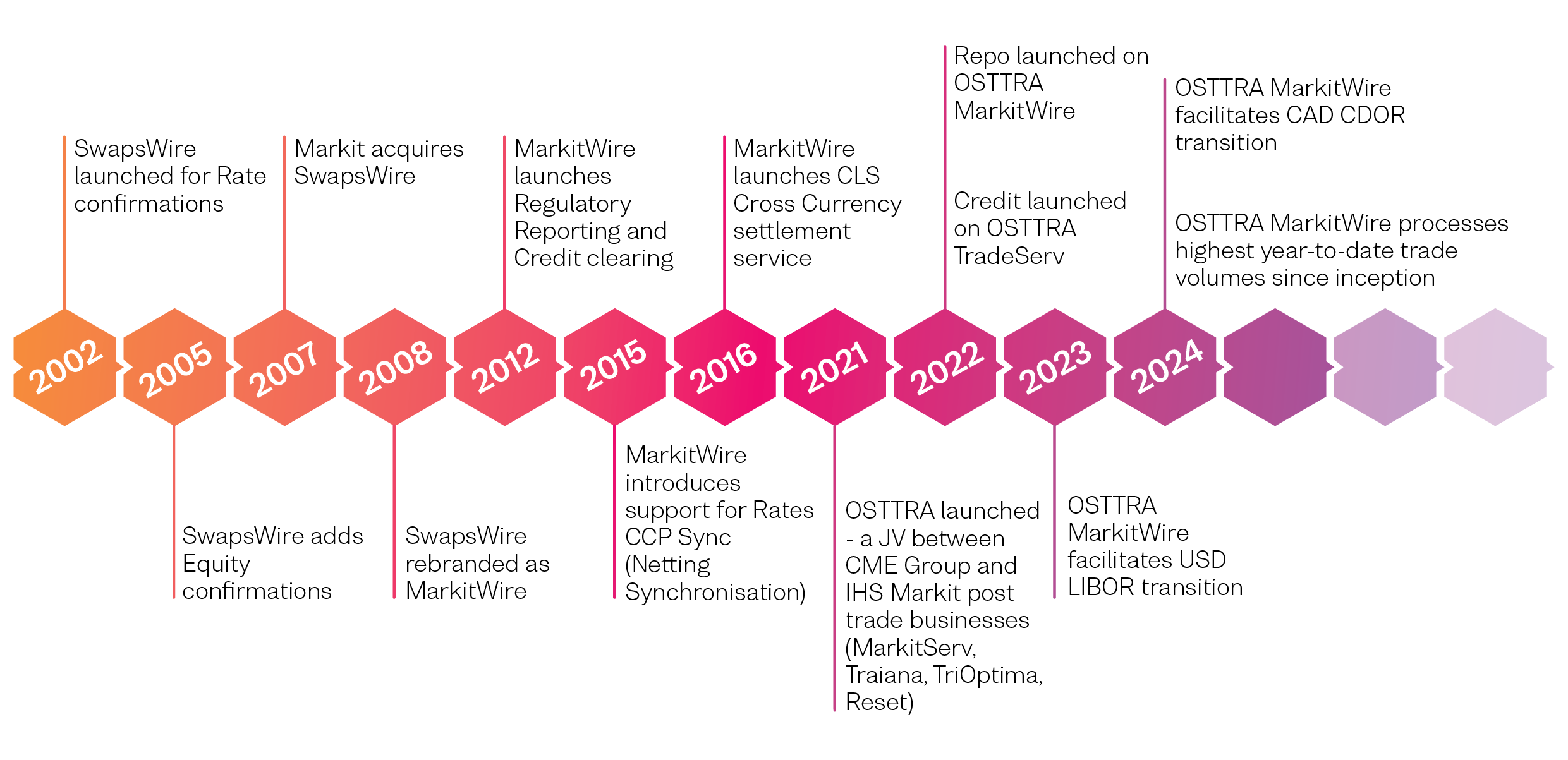

The financial markets have undergone a dramatic transformation in the past two decades, and OSTTRA MarkitWire has been at the forefront of this evolution. From its origins replacing fax-based confirmations to its current role as a leading fintech platform, OSTTRA MarkitWire has helped shape the post-trade landscape and actively participated in the evolution.

Momentous change in financial markets

Looking back, the sheer magnitude of change is striking. Gone are the days of cumbersome manual processes, when boxes of derivative confirmations were couriered to counterparties to agree trades, or trade records were faxed over archaic technologies. Today’s seamless electronic post-trade processes have come a long way, driven in part by new technology but also by market events. And while not all those events have been anticipated or welcome, the challenges they presented have spurred innovation and ultimately benefited the entire industry. The ramifications of the global financial crisis have shaped much of today’s over-the-counter (or OTC) derivative trade workflows. Legislation has been passed and successfully rolled out across market jurisdictions.

Reflecting on the past twenty years, we feel it’s essential to pause and appreciate the industry’s remarkable evolution and accomplishments, and the role OSTTRA MarkitWire has played. But the journey doesn’t end here. OSTTRA remains committed to partnering with clients to navigate the challenges and opportunities that lie ahead. Synergies across the OSTTRA business mean clients will have single streamlined workflows across large data sets; a marked difference to a past world of siloed interactions.

20 years of evolution

The story of post-trade processing is a journey of evolution, driven by technology vendors but guided by financial institutions. In the early days of SwapsWire, the original name for OSTTRA MarkitWire, the focus was on building a platform that could connect counterparties for electronic trade confirmation in the interest rate derivatives market and then quickly progressed to support clearing. This marked a significant step forward from the manual processes that dominated the industry.

Since then, the service has evolved into a comprehensive platform driven by straight-through processing (STP), significantly reducing operational risk by minimising human intervention. Today it comfortably processes tens of millions of trade records yearly, supporting rates, credit, equity, and repo transactions across 34 currencies and various product sub-types, with connectivity to 12 CCPs and multiple venues supporting 8 venue types. Building on this success, OSTTRA MarkitWire is transforming the bilateral repo market with our standardised, automated affirmation and confirmation workflows, while working with our customers to prepare for the incoming clearing mandates in the United States.

Furthermore, OSTTRA Trade Manager interacts seamlessly with OSTTRA MarkitWire providing investment managers and fund administrators with a consolidated matching and confirmation workflow across asset classes.

OSTTRA MarkitWire has a proven track record of supporting the industry through periods of significant change and uncertainty. When the Lehman Brothers crisis emerged in 2008, we worked with our clients and clearing houses to assist in an orderly transition of portfolios. The partnership has continued through the rollout of clearing best practices and mandates worldwide with OSTTRA MarkitWire connectivity extended to relevant CCPs, not only for clearing but also for post-clearing events, including the cleared trade IBOR transitions. The service now includes CLS settlement and connectivity to trade repositories for regulatory reporting.

In this era of complex and intense regulatory debate, OSTTRA has remained a steadfast partner, providing clients and partners with automated, digitised solutions, helping to manage the cost and complexity of change.

Consensus building – the keystone for centralised adoption

One of the most important roles a scaled technology provider can play is to act as a forum for rational industry-wide decision making. The industry expresses its mutual needs, and we provide intelligence, expertise and insight on how workflows can evolve to satisfy new regulations efficiently.

Market participants can struggle to collaborate and find cost-effective solutions to benefit the industry without setting off legal alarm bells. We have provided a safe forum for discussion since the initial launch with a member group of 23 businesses interested in standardising inter-dealer messaging in the rates market. Today we engage with a network of over 1,600 active participants across multiple working groups and the network continues to grow, particularly in emerging markets where the demand for market infrastructure increases.

With our partners we have taken the industry on a journey, drawing on new technologies and techniques as they have become available. That journey is not stopping now; on the contrary, OSTTRA marks a shift into a new gear, with the promise of compelling and synchronised benefits to our customers.

Marrying ‘T0’ and ‘T+’ post-trade processes

As OSTTRA, we have aligned our services to enable frictionless workflow for confirmation and reconciliation processes. Our full legal confirmation remains the key cog in our credit, rates and equity businesses – providing a golden source of agreed electronic derivative contract information to market counterparties, and creating a point of agreement and standardisation that enables trust.

Using this record in downstream T+1 activities lowers the resource burden for operational teams managing increasing volumes and system complexities. In today’s environment of ever-increasing regulatory scrutiny, banks must conduct assorted reconciliations across their technology infrastructures to ensure data accuracy and compliance. This includes reconciling data between their own global business units, between counterparties, with clearing houses and also the data they report to trade repositories.

Given OSTTRA’s interconnected post-trade services and 20 year track record, we are uniquely positioned to assist the industry in navigating these processes. This is our bread and butter. Increasing STP, harnessing the power of data, enabling synchronised analytical processes and allowing customers to optimise their resources most appropriately aligns with our vision and track record of marrying post-trade processes for the benefit of the industry.

In delivering for our clients i.e., by connecting OSTTRA MarkitWire and our portfolio reconciliation service, OSTTRA triResolve, we endeavour to add further use cases that bridge the synergies within OSTTRA. Future cases will span different asset classes and platforms, amplifying the resource optimisation benefits our customers are continually searching for and removing redundant processes for good.

Partnering with the industry through Interest Rates reform and transition

Financial market professionals will be well-versed with the global introduction of overnight risk-free rates (RFRs), replacing legacy interbank offered rates (IBORs), across multiple markets and currencies. For over 20 years the legacy OSTTRA businesses have helped navigate industry change like central clearing, regulatory reporting, compliance timeliness, and disclosure of material economic terms (METs). Benchmark reform is no different.

OSTTRA MarkitWire’s CCP Sync services for Rates initially focused on netting, compression, and portfolio transfers. By listening to multiple CCP updates and absorbing trade messages back into customer systems via existing APIs, we enabled advantageous STP workflow and mitigated the need for customers to build additional post-trade connectivity. As clearing continues to evolve across various jurisdictions, this connectivity remains as important as ever.

Enter benchmark reform through clearing events – the process of running high-risk, multi-year projects of transitioning millions of trades from IBOR rates to new RFRs. Using our CCP Sync service, hundreds of customers have avoided expensive ‘blue ocean’ builds and instead utilised the OSTTRA MarkitWire connectivity to multiple CCPs and coverage of key market currencies, to achieve transitions in an automated manner. We partnered with the industry through the initial IBOR transitions in 2021 and the notable USD Libor transition events in 2023 – the work continues today.

As various markets and regulators continue to review and update legacy rates – most recently Canada, and looking ahead to Mexico, Japan and Israel – rest assured the OSTTRA team is on-hand to deliver exceptional CCP Sync services that reduce cost and risk through low latency and resilient frameworks. We have no doubt legacy rates will remain in certain markets, and that’s OK; our aim is to partner with the industry across their broader portfolios of trades, be they cleared or non-cleared, and when the time is right, we’ll be there to support rates transition activity.

It’s not about the destination, it’s about our journey together

So the question is, where does the industry go from here? With a backdrop of exciting new technologies such as distributed ledger and artificial intelligence (AI), our experts are naturally following these developments and applying innovative and incremental changes to our products, for example, OSTTRA Trade Manager’s Paper Digitisation module. We view these changes as natural improvements to the existing products that have served the industry so well.

Most importantly, we look to our clients to shape our functionality roadmap. Their input may be driven by technology, the pursuit of greater operational efficiency, or challenges arising from new ideas or regulatory and compliance needs. Whatever the use case, we are committed to working collaboratively with the industry. We are not in the business of advocating shiny new technologies for their own sake, our philosophy is to advance the needs of the industry, building on 20 years of connectivity, evolution, resilience, partnership and transparency.

Two decades of experience have prepared us for the next chapter of post-trade. We’re embracing the challenge and the technology, collaborating with our clients to build a future defined by efficiency, innovation, and connectivity. The future is post-trade, and it starts now.

For more information, contact info@osttra.com