From monitoring bank balances to tracking package deliveries, we’ve grown accustomed to having information at our fingertips. But what about the state of post-trade operations in the capital markets? As regulations tighten and demands for efficiency are increased by the transition to one-day settlement cycles in US securities, the need for real-time visibility and control in post-trade operations is becoming paramount.

The act of onboarding clients and the processes around trade allocation, confirmation and affirmation are unlikely candidates for headlines about transformative technology innovation when pitched against the thrill of front office trading and the excitement that AI and blockchain technologies still generate. And usually they can’t compete – even if all institutional trading relies on the efficient and robust running of post-trade systems behind the scenes.

But this year is post-trade’s time to shine. The SEC’s decision to shorten settlement times to T+1 has sparked a rush of interest in the sector: once the bonnet was opened, market participants started wondering if it was time for a full vehicle inspection. Even though the focus of the regulation for T+1 settlement is securities, there is an indirect effect on FX and fixed income too, and many firms are now taking an holistic view on operations processes across all asset classes. Shorter FX trading-settlement timeframes reduce the window for resolving issues, necessitating efficient and timely technical account onboarding, data completion, and issue escalation, especially given the complex, multi-regional nature of cross-asset processes.

Our Onboarding, Connectivity and Operations service enhances post-trade operations and connectivity, enabling clients to efficiently monitor and manage their networks. Just as your smartphone app keeps you informed about your financial health and the whereabouts of your Uber ride, post-trade operations now require a similar level of real-time transparency and accessibility at a time when supervisors’ stance towards operational challenges is becoming increasingly unforgiving. The pressure is on for banks and investment managers to demonstrate full control over their post-trade processes. Like tracking your Uber’s journey, operational teams need to know where trades stand, identify bottlenecks and errors, and take proactive measures to ensure timely settlement.

Regulation and oversight as key drivers

A single change in the overall financial market ecosystem often has ripple effects across the whole network, with some consequences more noticeable than others.

In the case of moving to a 50% shorter settlement time for US securities, market participants in FX will have 83% less time to perform post-trade processes than in the current regime, according to calculations from industry association AFME.(Source)

Another key consideration is whether the shorter timeframe will affect performance, or in other words whether the risks of failed trades and operational errors would increase. The short answer, according to both AFME and buy-side industry participants, is an overwhelming yes.

Post-trade efficiency is firmly in the sights of regulators and industry oversight bodies. In currency markets, the FX Global Code of Conduct is calling for better operational processes, including more timely confirmations as well as a general technology upgrade to increase efficiency and accuracy. The standard-setting body for OTC derivatives, ISDA, continues to focus on give-ups and the timings associated with communications around them.

In European securities markets, the settlement discipline regime of the Central Securities Depositories Regulation (CSDR) has introduced several measures to reduce the number of settlement fails, to prevent such failures and to cajole market participants into settling accurately on the intended dates.

In the futures markets, FIA and DMIST, the Derivatives Market Institute for Standards, jointly announced the publication of the Final Standard for Improving Timeliness of Trade Give-Ups and Allocations, designed to improve the delivery and processing of allocation instructions by establishing 30-minute timeframes for completing steps in the allocation process .

In summary, regulators and oversight bodies are quite clear in their messaging to market participants: operational failures such as trade breaks, and system outages will be met with a zero-tolerance policy from rule makers, and full historical post-trade transparency and visibility is a must.

.

Change for the better: real-time service monitoring and more

To comply with these rules, market participants need to have more granular visibility into what happens to trades after execution, which in turn requires infrastructure and service providers to step up their game in areas such as flexibility of access, onboarding and integration, among others. That means it’s all eyes on onboarding, connectivity and operations.

Achieving this operational upgrade is more complicated than it sounds, due to the complexity of the post-trade ecosystem and the varying levels of technology requirements participants have. Legacy and fragmented post-trade infrastructures across multiple systems and vendors have to be consigned to the past in favour of a single, more closely-coupled system.

It’s in everyone’s interest to have better visibility into the health of the systems, services and counterparties involved in the affirmation, matching, confirmation and clearing of trades. Consider your Fitbit alerting you when your heart rate spikes unexpectedly. Similarly, in post-trade operations, timely alerts and diagnostics are crucial for identifying and resolving issues before they escalate. Whether it’s pinpointing delays in trade processing or diagnosing connectivity issues with counterparties, the ability to swiftly address problems is vital. With T+1 settlement approaching, the stakes are higher than ever, akin to keeping a close eye on your health indicators to prevent potential complications and unpleasant surprises.

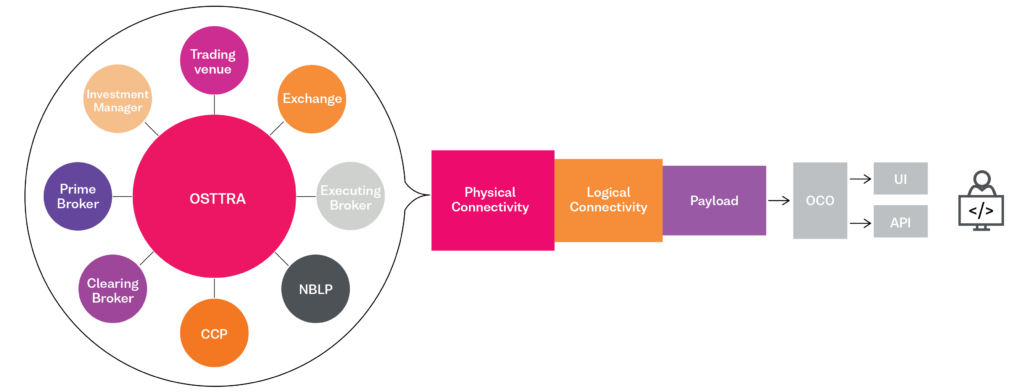

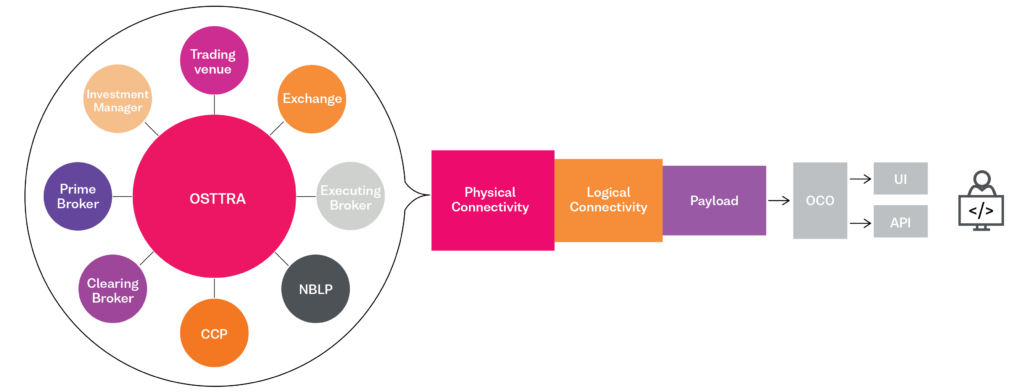

Just like we have become accustomed to skipping queues through self-service, banks and investment management firms are requesting greater autonomy with respect to the initial integration and technical onboarding of their systems and underlying clients through self-service tools. The expectation is that this should be combined with greater visibility into the health of their post-trade networks and services including the physical and logical connections used to carry messages between market participants, all supported by a comprehensive customisable reporting suite. This includes greater flexibility with respect to accessing services, which is fueling demand for Single-Sign-On (SSO) and operational dashboards driven by real-time data accessed via API.

In response, OSTTRA has developed a new service for its clients – OSTTRA’s Onboarding, Connectivity and Operations (OCO) Suite – enabling network participants to track the health of their post-trade operations across asset classes and counterparties. The initial release provides enhanced system monitoring:

Get granular visibility into what happens to trades after execution with OSTTRA OCO.

While the cost of operational failures has never been higher, regulatory and supervisory forces are combining with business needs to create an unusually difficult landscape to navigate. This is why market participants need to move towards a single screen to view operational processes and away from the current, fragmented approach.

This desire is reflected in the exchange traded derivatives (ETD) market, according to the findings of a March 2024 listed derivatives study, produced by Acuiti in association with OSTTRA: Almost 90% of ETD market participants surveyed said that it would be either crucially or very important to have a consolidated view of T+0 and T+1 processes, a desire particularly evident among the sell-side. The biggest benefits of such a view would be in risk reduction according to survey respondents, but there are also perceived upsides in operational efficiency and costs.

Clearly, as the industry prepares for an unyielding approach from regulators around trade breaks and systems down time, market participants need better visibility into the health of their systems, networks and trade status as well as an easier ride in terms of interacting with and managing processes.

When a Prime Experience Comes to Post-Trade Operations

Against an accelerated market dynamic, market participants want greater autonomy to go at the pace needed to bring solutions to market quickly. They are asking for the ability to use self-service tools during the initial integration and technical onboarding of their systems and underlying clients and they want to combine these with a greater level of visibility into post-trade networks and services, in a way that’s personalised and intuitive, just like the everyday instances of self-service we’ve all become used to.

After all, this already happens in other areas of life: the ability to track packages, taxis and food orders after the purchase is taken for granted in most customer-facing areas. Amazon customers rarely need to call the Amazon helpdesk because the service interface gives you all the info you need about your past and pending orders, orders currently out for delivery, mechanisms for raising queries and product how-to features, among other things.

For post-trade, this means an increased granularity and visibility into connections that handle messages between participants, both physical and logical, and a comprehensive and customisable monitoring suite. There is also growing demand for creating a Single Sign-On entry point for services in the same bucket to streamline workflows and step-up efficiencies.

Abundant data and the ability to easily channel information through automatic API connections has given rise to expectations that processes and exceptions should be viewed in real-time in a convenient format such as a dashboard.

But it’s not just ease of access and user experience that’s driving the quest for efficiency in post-trade, and it’s not just regulatory change either. As large financial market players continue to face headwinds, even marginal improvements along the post-trade lifecycle can make a meaningful difference to balance sheets.

In the year ahead, these headwinds will persist, according to consulting firm Deloitte, which predicted in its 2024 outlook for financial services that “banks’ ability to generate income and manage costs will be tested in new ways” while noting that “multiple disruptive forces” are conspiring to reshape the foundations and the architecture of banking and the capital markets industry.

These factors are making it imperative for market participants to see and manage the whole picture, not just parts of the post-trade jigsaw puzzle. It’s a small surprise, then, that Acuiti’s study predicts a push towards consolidation of vendors and processes, as market participants strive to reduce complexity. The survey found that the overwhelming majority of companies are now looking to consolidate their relationships with vendors to those that can offer comprehensive post-trade services covering the full lifecycle of trades.

What It Takes To Turn Post-Trade Into A Five-Star Rated Experience

Just like when you decide to cancel your booked Uber ride when your driver is stuck in unexpected traffic, market participants should be notified about any and all events that impact trade matching. Factors to monitor should include physical and logical connectivity, system outages, platform performance as well as failed and pending messages, which impact match statuses, trades processed and associated market participants.

Trades could fail for a variety of reasons but market participants get little actionable information about such events at the moment. Better visibility into what happens to trades before they arrive at the back office is one of the key areas where there is demand for improvements, especially if there are operational reasons involved in a failure.

Rather than just identifying that there is a discrepancy, market participants should be able to tell which trades are having issues due to operational reasons and where those problems are before failures happen. The ability to see in real-time the status and health of trades as they traverse trade lifecycles and ecosystems would reduce the chances of errors creeping in unnoticed and resulting in failures or broken trades.

Similarly, dealing with exceptions should be easier and solved in a way that allows firms to track, manage and resolve these issues as soon as possible and in a structured manner. Automating incident management and allowing both parties to track them, enhancing both inter- and intra-company collaboration and enabling remediation are actionable steps for the industry.

Reporting is also ripe for upgrades and it’s an area where market participants would benefit from better visibility into operational and trade level metrics as well as the ability to compare and benchmark firm-level performance against peers. Having more control and autonomy over the format and frequency of these summaries and insights would allow institutions more flexibility to prove good performance and regulatory compliance.

Standardising how post-trade information is accessed and distributed is also something where efficiency gains need to be made. Adopting API connectivity for post-trade workflows and operational data access would significantly upgrade the quality of the user experience and increase the utility of the data and information.

These are just some of the examples that could benefit the overall ecosystem and promote the health of both the post-trade networks and its participants. The Onboarding, Connectivity and Operations service for OSTTRA clients aims to address this challenge by offering a seamless way of increasing transparency and control of post-trade operations:

OSTTRA for Onboarding, Connectivity and Operations

What three words for the post-trade path ahead: volatility, risk and control

Equity markets are surging to new highs and risky assets continue to remain buoyant despite interest rates in major economies staying at multi-decade highs. The approval of Bitcoin ETFs has launched crypto on Wall Street for real, in a year when the world’s population is heading into a record number of elections. Rate cuts, new dynamics in some markets and quite a lot of event risk are conspiring to lay the groundwork for elevated volatility.

For traders, this is great news because high volumes and volatility promise the possibility of rich pickings. From an operational point of view, it’s a more mixed outlook that will be about balancing the need to manage operational risk with the need to heed the shareholder call to achieve operational efficiencies that shore up margins.

As this financial landscape evolves rapidly over the next year, the accelerated evolution of post-trade towards on-demand operational insight and real-time monitoring is not merely a regulatory necessity but a strategic business imperative. Just as we rely on seamless digital experiences in our daily lives, financial institutions must adapt to this new paradigm: Instantaneous visibility and control aren’t just conveniences; they’re essential tools for mitigating risk, ensuring compliance, and optimising performance. With T+1 settlement leading the charge, the push for transparency and efficiency will extend beyond equities to encompass other asset classes like FX and fixed income, and far beyond the borders of the United States of America, with post-trade pundits expecting a move to T+1 in the UK and the EU in 2025.

Learn more

Our OCO suite helps OSTTRA clients improve operational control and reduce operational risk through the delivery of automated service connectivity, self-service onboarding, real-time service monitoring and exception management, and customisable reporting. To find out more, please visit OSTTRA for Onboarding, Connectivity & Operations.