Following eight years of delay and postponement, the ‘4210’ rules finally come into effect 22 May 2024. In-scope firms with covered agency transactions, including To Be Announced (TBAs), pool transactions & Collateral Mortgage Obligations (CMOs) will become subject to daily margin requirements (or equivalent capital deductions).

What should firms focus on?

While immediate priority should be given to establishing and updating legal Master Securities Forward Transaction Agreement (MSFTA) documentation, the broader challenge is to establish the BAU processes to correctly identify in-scope trades, perform daily MTM valuations and manage margin exchange (or capital deductions).

How can OSTTRA help?

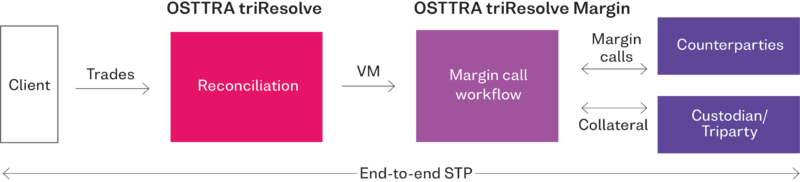

Ahead of the regulatory go-live, firms are already using our services to manage both reconciliation and margining of their MSFTA portfolios.

OSTTRA triResolve provides an automated way to align portfolios & resolve differences. We reconcile over 90% of all bilateral OTC derivatives across 2,000+ groups. You benefit from a centralised service model with a global network where you and your counterparties share the same view and work together to resolve any differences.

OSTTRA triResolve Margin leverages the portfolio reconciliation data and automates the margin call exchange & collateral settlement process.

Benefits

Standardisation & Optimisation

Simplifies data capture & normalisation, supports data quality checks and provides best-practice workflows across products.

Cost Effective

Our transparent pricing model is pay as you go with no hidden fees.

Rapid onboarding

No installation required. Be up and testing in days.

Operational efficiencies

Retire manual processes – reducing operating costs and allowing you to focus resources on risk & compliance.

Robust dispute resolution

Reconciliation analytics pinpoint where you have disputes and identifies what is driving them.

Multiproduct coverage

Multi asset class and product support including Bilateral, Cleared, ETD, Repo and TBA.

To find out more about our Margin solutions, contact us below.