Volumes in FX options markets are surging and there is no sign of a let-up as interest rates change in major economies when newly elected administrations across a record number of jurisdictions are settling in to govern. The election of Donald Trump as US president may drive increased demand for FX options, as both hedgers and speculators look for ways to navigate expected market shifts and uncertainties.

Given the macroeconomic and geopolitical backdrop of 2024 and looking ahead, the popularity of contracts that grant holders the right but, crucially, not the obligation, to buy or sell assets at a pre-agreed price is understandable, since optionality in times of elevated uncertainty is a highly prized feature.

Overall, traded volumes in FX options have risen 58% year-on-year, according to the US Federal Reserve’s latest FX survey, while the Bank of England recorded a 41% rise in the same period.

As underlying volumes increase, idiosyncratic volatility events, such as the spectacular unwind of the Japanese yen carry trade at the start of August 2024, result in peak volumes that put significant pressure on operations in these traditionally voice-dominated markets, particularly in dealer-to-dealer markets, exposing the inefficiencies and vulnerabilities of manual processes throughout the trade lifecycle. This potential for increased operational risk is driving new interest and adoption of electronic processes in both the front and back office, as we’ll explore below.

In the dealer-to-client space, where electronic processes are more established, multi-dealer venues have seen their FX options volumes nearly triple in the past six years, driven by best execution mandates as well as the quest for efficiencies. The dealer-to-dealer market has been considerably slower to migrate to electronic trading, with interdealer brokers (IDBs) still facilitating most of the trading activity. Interdealer clearing volumes have likewise exploded over the past year, bringing focus on operational risk reduction through the removal of post-trade inefficiencies.

Exploding volumes catalyse market structure change

The surge in FX options trading volumes can be measured across many OSTTRA post-trade services, which are used by the industry to efficiently process trades across multiple steps of the lifecycle.

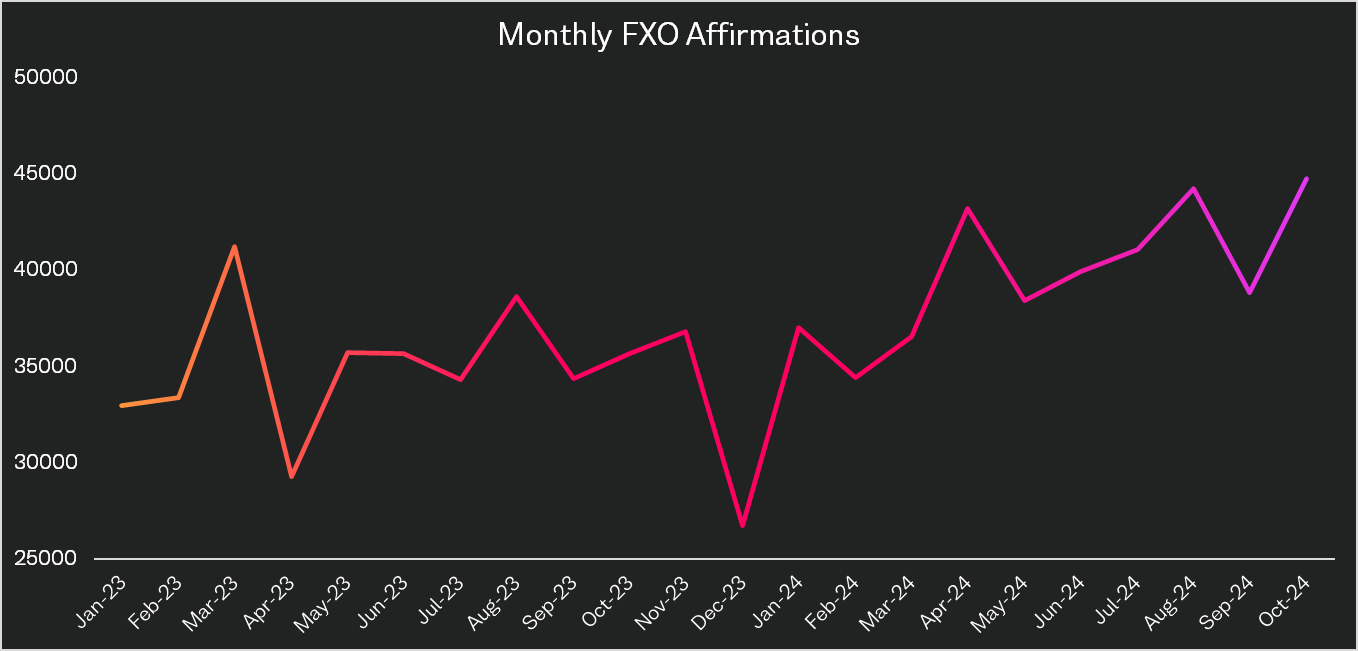

Interdealer Broker Affirmation

The OSTTRA IDB affirmation service (FXBA), which connects dealers with their brokers to enable affirmation and straight-through processing of executed trades, has seen average monthly volumes increase around 16%, from around 34,500 per month in 2023, to 40,000 per month, on average, in 2024, or 25%, comparing the month of October 2023 with October 2024.

This uptick can be seen as a direct result of more front-office activity, but it also underscores the quest for more efficient and automated processes throughout the trade lifecycle. High-volatility stress events in recent years have seared into institutional memories the importance of risk mitigation through low-latency post-trade processes. When execution moves at millisecond speed, post-trade processing needs to keep pace, without growing volumes causing delays or costly errors.

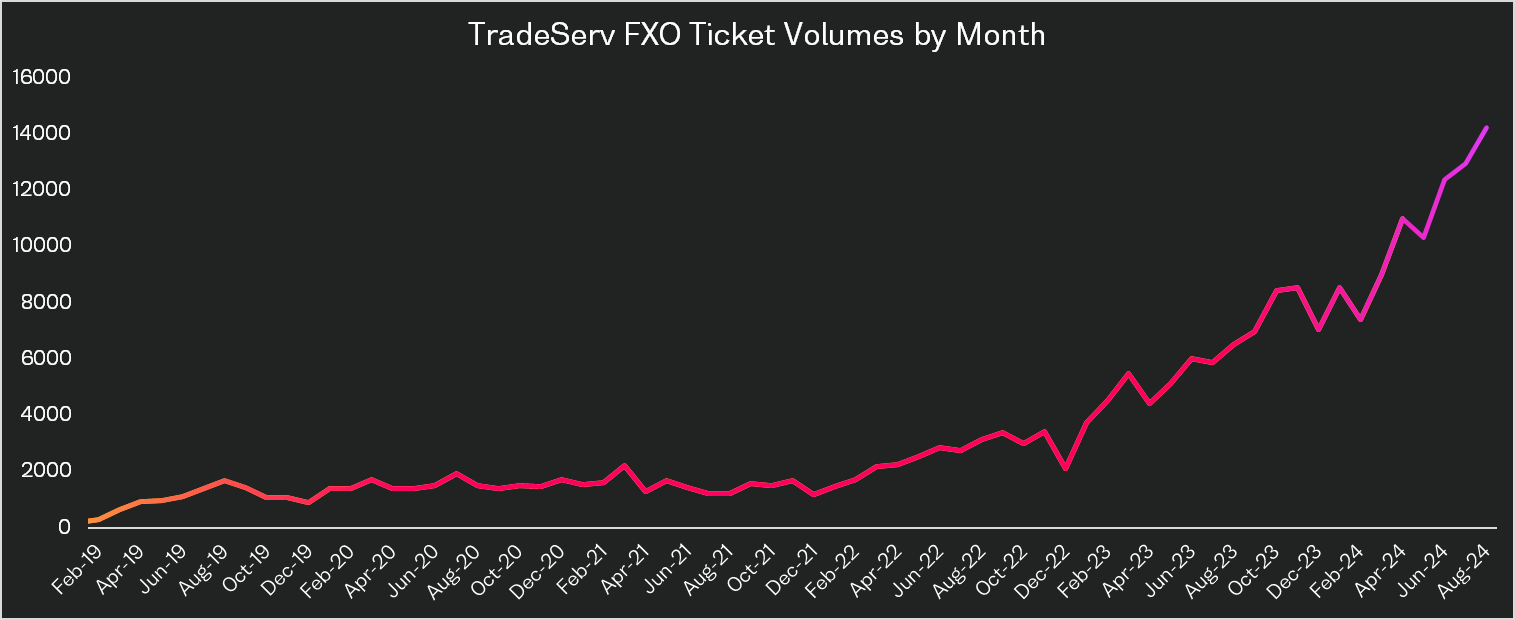

Centrally cleared FX options

Uptake of interdealer clearing has also seen a marked increase over the past year as firms look to manage counterparty risks more efficiently. Illustrating this trend, OSTTRA has seen ticket volumes more than double on its FX options matching and clearing connectivity platform (OSTTRA TradeServ), which manages the workflows required to prepare and submit executed trades for clearing at global central counterparties, from a monthly average of just above 5,000 in 2023 to almost 11,000 in 2024 (comparing the available data from this year and the same time period last year). And 2023 did not present a particular lull in FX options trading, as previous years tended to be more lacklustre.

While the volume of trades sent to clearing remains much lower than the total IDB-affirmed trades, this is changing as more dealers move towards a cleared model. We can fully expect to see FX options cleared volumes continue to increase.

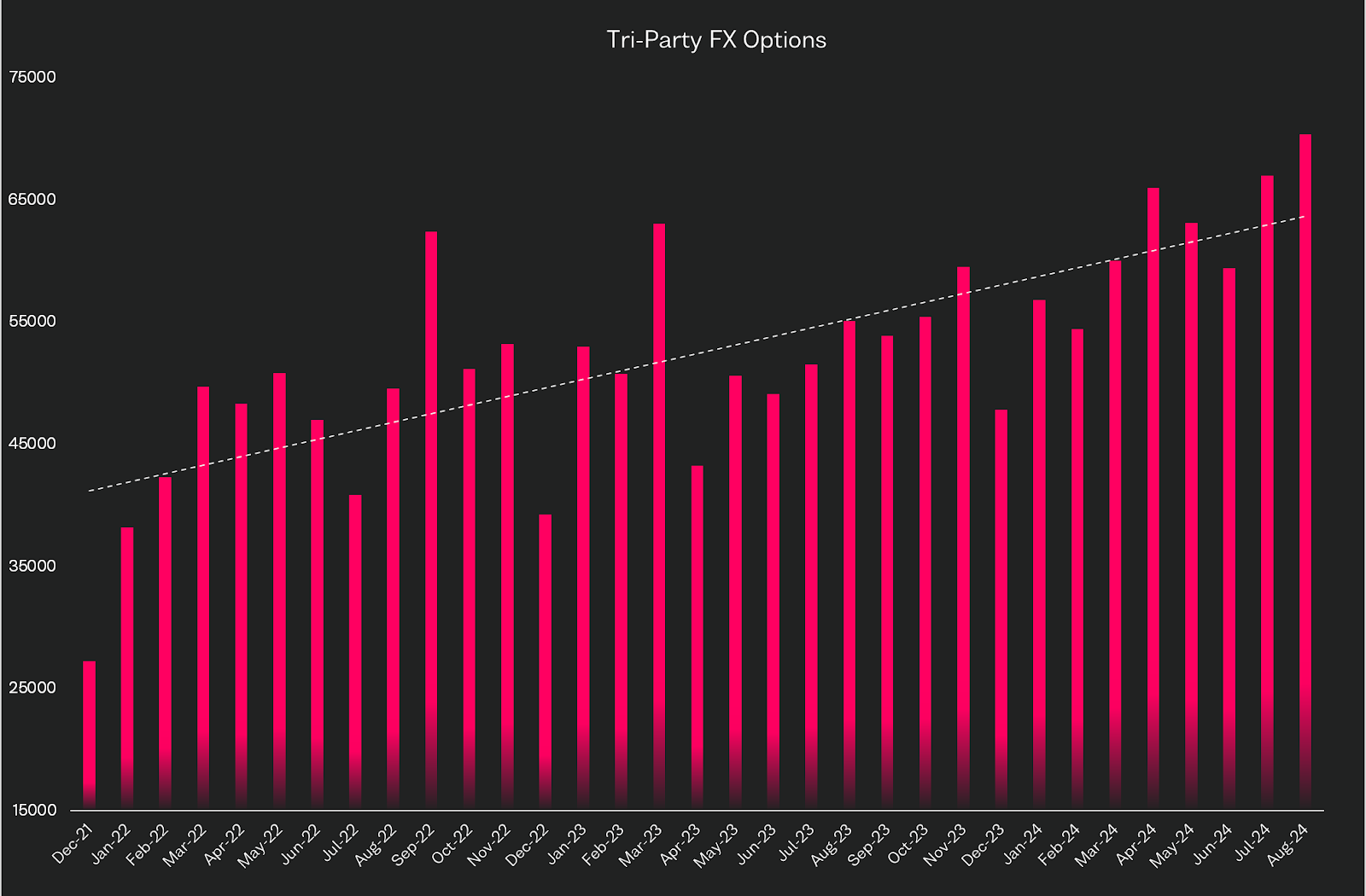

Tri-party FX options (prime brokerage)

The increase in volumes noted in the interdealer market is being replicated by hedge funds trading with executing banks under tri-party agreements, with our tri-party trade processing service – FX ClientLink and Message Center – also seeing substantial and sustained volume increases. We have seen an average uptick in FX options trades of 20% for the first eight months of this year compared with the same period in 2023, and 36% compared with the same period in 2022.

Risk management under the microscope

The surge in FX options volumes has increased demand for the timely updating of traders’ risk systems, ensuring positions are current as soon as technologically possible. OSTTRA supports post-trade messaging through its post-trade notification services, which provide firms with the ability to publish and receive notices of execution across a large network of trading venues, single-dealer platforms and trading counterparties.

Heightened counterparty credit risk has been a big topic in prime-broker industry working groups in recent years, with a growing demand to tie credit limits defined in designation notices with a real-time view into client utilisation for executing brokers. OSTTRA has provided a post-trade view of prime broker client utilisation to executing brokers for many years as part of its credit management suite, which has now been enhanced to support queries on a pre-trade basis.

“Automating this post-trade workflow is crucial for enhancing operational efficiency and reducing risk”

– Steve French, OSTTRA

Early adopters are integrating the service directly into their internal risk systems using a bidirectional application programming interface to perform real-time pre-trade credit checks for FX options against client limits defined in our designation notice management service. In a further enhancement, the monitoring service is being equipped with vega measurement to provide subscribers with options valuation sensitivity.

Exotics take centre stage

Firms that have historically traded vanilla FX options are now looking to trade more exotic instruments, but this can only be supported across the trade lifecycle on an automated basis if all touch points and processes are uplifted to support these trade types. FX options, by their very nature, are more complex than other FX instruments and rely on post-trade events being triggered to access any underlying asset.

The automation and collaborative management of these events, including the various flavours of exercise and expiry, is attracting renewed attention from market participants. To address the growing demand for broader exotics support, OSTTRA expanded its FX options trade processing services several years ago, and is now collaborating with market participants to increase adoption and leverage the long-standing post-trade event management capabilities of its networks. This collaborative effort aims to reduce manual processes and increase FX options’ straight-through-processing (STP) rates across the industry.

Navigating FX options automation: collaboration matters

Our post-trade services play a critical role in managing rising FX options volumes, but a collaborative industry approach is required to increase STP rates and the use of features associated with lifecycle events, including exercise and expiry.

A great example is the partnership between OSTTRA and SpectrAxe to implement an end-to-end solution aimed at streamlining FX options trading by automating the entire trade lifecycle. SpectrAxe, a US-regulated swaps execution facility, has gone live with the first central limit order book (Clob) to facilitate all-to-all trading for over-the-counter FX options. The venue enables hedge funds to trade anonymously with other hedge funds, proprietary trading firms, regional banks and market-makers via their FX prime broker relationships on a ‘lit’ marketplace. It’s the first electronic Clob trading platform for OTC FX options, an area of the market that remains heavily reliant on voice- and chat-based execution or single-dealer platforms.

Specifically, the offering works from price discovery through to execution, booking and risk management within the FX options market – combining SpectrAxe’s price discovery and execution Clob with the OSTTRA post-trade network, using our affirmation and trade notification services. Automating this post-trade workflow is crucial for enhancing operational efficiency and reducing risk. This combined expertise provides market participants with a streamlined, automated process that not only saves time but also significantly reduces the potential for errors.

This intricate web of technology and connectivity provides the flexibility required for broad market coverage and greater participation. It’s a cost-effective way to optimise workflows and mitigate operational risks in the post-trade lifecycle management of FX options and adoption rates suggest a strong appetite to address these challenges as volumes grow and costs and risks multiply.

With OSTTRA, clients can affirm trades from any bank and submit post-trade allocations to any prime broker, streamlining their entire post-trade management practices for FX options and a broad range of other asset classes. For more information, contact info@osttra.com or visit osttra.com/fx