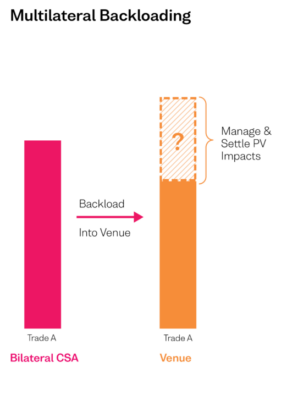

Our seamless mechanism for backloading trades into clearing or settlement venues leverages the multilateral benefits of bulk optimisation and processing connectivity via OSTTRA MarkitWire, allowing customers to benefit from efficiencies and processes such as CCP conversion events.

Participants simply submit their non-cleared trades with the expected PV impact from backloading. Our algo identifies the maximum number of trades that satisfies each participant’s tolerances, and the existing trades are amended in OSTTRA MarkitWire to automatically send for clearing.

Benefits

- Enables eligible trades to gain access to CCP Conversion

- Fewer trades are reliant upon ISDA Fallbacks

- Reduces portfolio fragmentation

- PV impacts can be constrained multilaterally as opposed to per counterparty

- Trade processing via OSTTRA Markitwire includes

o Pre-conversion – clearing eligibility check

o Post-conversion: bulk backloading to clearing

The service was launched in 2023 for SGD-SOR & THB-THBFIX but now includes

· USD, EUR & GBP Inflation Swaps

· CAD-CDOR IRS

· MXN-TIIE 28D IRS

· PLN-WIBOR IRS