We are pleased to announce that the OSTTRA triBalance Capital Optimisation service is now live with SA-CCR optimisation of settled-to-market netting sets by proposing new overlay trades designated into SwapAgent. This functionality is now available in both our Interest Rate and FX optimisation runs.

In December last year we completed the first Interest Rate cycle where we optimised bilateral and cleared exposures alongside participants settled-to-market exposures. The first FX cycle to include SwapAgent overlay trades followed shortly thereafter and was completed in January.

“Leveraging SwapAgent and its STM procedures presents new opportunities for our clients to further reduce capital costs under SA-CCR.”

Christina Högegård, Business Manager OSTTRA triBalance

Counterparty credit risk impacts a firm’s cost of trading due to capital requirements, driven by RWA and Leverage Ratio, and funding costs driven by Initial Margin. We are running frequent optimisation cycles in both FX and Interest Rates where our customers can proactively manage RWA and Leverage Ratio requirements, calculated using SA-CCR or Internal Model Method, while simultaneously optimising Initial Margin

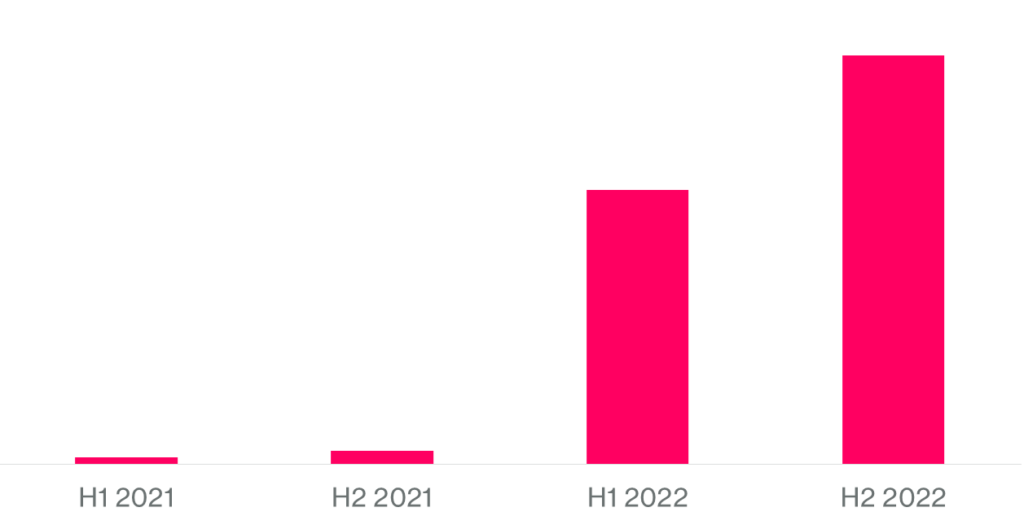

Semi-annual FX and interest Rate Capital Optimisation

“We welcome OSTTRA triBalance using SwapAgent’s risk management and standardisation process for the bilateral market as a building block in their margin and capital optimisation.”

Nathan Ondyak, Global Head of SwapAgent

To discuss your capital optimisation needs, contact info@osttra.com.