Following the launch of Trade Refactoring one year ago, we have seen an increase in adoption over the last few months. This has enabled OSTTRA triReduce to unlock additional benefits for compression participants, resulting in USD 1 trillion of additional gross notional reduction in LCH SwapClear during September 2022 alone.

Trade Refactoring is the most sophisticated form of portfolio compression available for cleared OTC Interest Rate Swap portfolios and will remain a key tool as major global banking institutions ready themselves for their end of year regulatory reporting requirements.

Benefits:

- Enables compression of trades that cannot be compressed by netting or blending

- Can be adopted unilaterally, so there is no need for critical mass adoption to achieve efficiency benefits

- Sticky trades can now be reduced

- Generates a significant one-off reduction and has proven to be at least 10% more efficient at compression than Trade Revision on an ongoing basis

How it works:

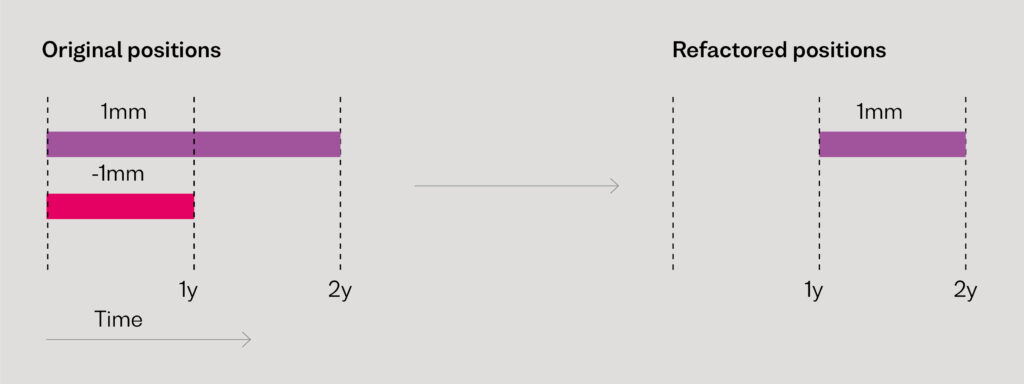

Two spot trades that cannot otherwise be compressed in risk-free netting, or in multilateral compression without offsets in the CCP, are replaced with a forward starting trade.

There are no additional submission requirements for firms running with Trade Revision.

Contact us at info@osttra.com to learn more or request a demo.

Useful Links

Trade Refactoring Press Release