The introduction of the new capital regulation, Standard Approach to Counterparty Credit Risk (SA-CCR), drastically changes the metrics used for deriving the capital cost. For many years, under the Current Exposure Model (CEM), the capital costs have largely been driven by the total gross notional. Under SA-CCR, this shifts to using risk-based counterparty exposure instead. This is a rather fundamental change of methodology, which could have a huge impact on trading behavior, as well as post-trade portfolio optimization.

If we look specifically at the FX market, it differs from the rest of the financial markets in that it largely remains outside of the bilateral initial margin requirements introduced with the uncleared margin rules (UMR) a few years ago. Physically settled FX trades are exempt from UMR and thus do not attract any of the costs associated with funding bilateral initial margin (IM) for market participants.

To analyze how the industry could mitigate the cost of holding capital on balance sheets under SA-CCR, TriOptima conducted a study based on the trade population between the 20 largest banks in the seven largest currency pairs. In this study, we calculated the capital costs under the CEM and compared these with the costs under SA-CCR.

The first conclusion from the study was that the capital cost for the industry remained largely unchanged under the two regulations. For some banks, the cost was lower under SA-CCR, and for others, it was higher. In other words, there does not appear to be any automatic capital cost rebate as a result of SA-CCR.

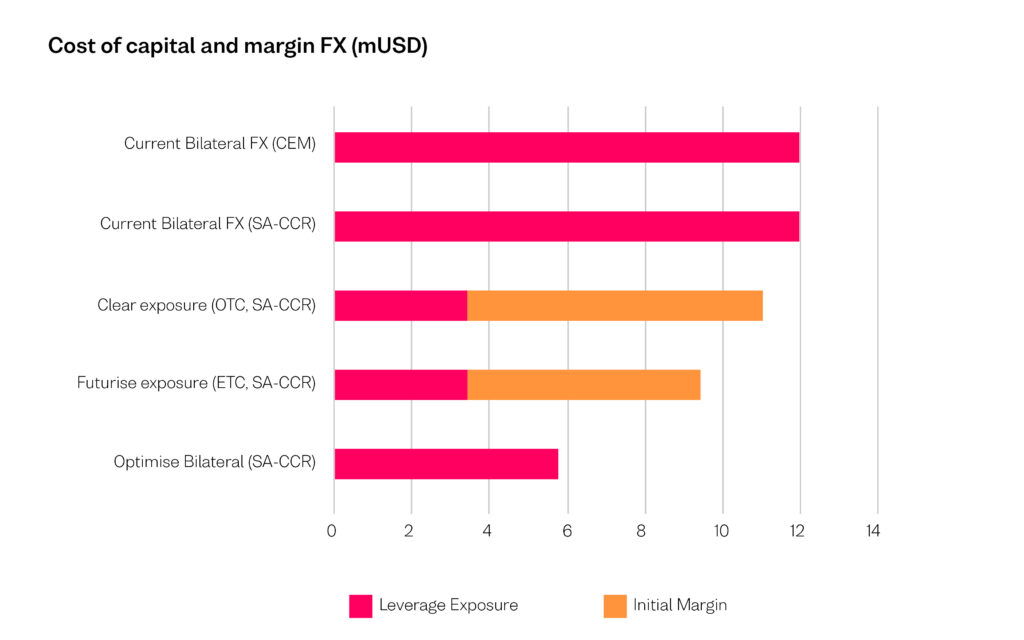

We then analyzed the potential for reducing the bilateral exposures through different methods, with the goal being to reduce the capital cost under SA-CCR. The largest reduction of capital costs would be achieved through futurisation of the trades (i.e., converting the OTC exposures into exchange-traded derivatives, or ETDs), or through clearing the OTC forwards. The study showed that either option would remove at least two thirds of the capital cost. However, in both cases, the trades would switch from being unmargined (as FX Forwards are not subject to UMR) to margined trades, thus incurring the additional IM expense would drastically limit the savings made when looking at the all-in cost.

The third alternative is to keep the FX forwards bilateral but optimize multilaterally. This means that bilateral delta exposure is redistributed between counterparties to minimize the total counterparty risk (and hence their capital cost), e.g., by moving an exposure facing one counterparty to instead face another counterparty where it offsets an outstanding risk, and hence reduces the total exposure across both counterparties. The netting in this case is not quite as efficient as with clearing and futurization, but residual exposures will remain bilateral and will thus not be subject to any additional cost of initial margin. That means the all-in cost of the portfolio would be significantly lower compared to the other two options.

The results of the different alternatives described above are highlighted in Graph 1.

Different market participants have different objectives based on their portfolio structure, IT infrastructure, etc., and we will therefore likely see a combination of different methods for tackling the new reality under SA-CCR, just like has historically been the case when capital regulations change. Some will use OTC clearing because it is the best fit, others will use futures. However, our conclusion is that we are not likely to see a mass-exodus from bilateral OTC trading in FX forwards, since the economic incentive simply is not there.

Even in the case of FX NDFs, which unlike FX forwards are bilaterally margined, the cleared volume falls well short of the total volume. Operational constraints, particularly in the prime broker space, have, to a significant degree, prevented trades from being cleared.

To efficiently manage post-trade optimization of their FX portfolios, market participants need to consider both the exposure under SA-CCR and under UMR. Thus, any post-trade optimization model that takes SA-CCR and UMR into account would seek to minimize both the total FX exposure and the FX exposure in scope for UMR.

In addition, there are several other metrics that incur different costs, including risk-weighted assets, gross notional outstanding, balance sheet usage, etc. If different metrics are managed and optimized in separate processes, it can quickly lead to sub-optimization when the benefit of improving one metric is offset by increased costs from unintended changes in other metrics. This means the optimization model needs to be able to take multiple different metrics into account simultaneously.

Furthermore, optimization services that redistribute or rebalance risk within a network is based on the idea that injecting an offsetting “hedge” transaction into an existing trading relationship can reduce the outstanding risk, and over time, the cost of capital from, for example, SA-CCR. However, by also including the trade population available for compression, the reduction of bilateral exposures can also be achieved by terminating transactions that contribute to the existing bilateral exposures. Combined, terminations and new trades together allow that reduction of gross notional is balanced against net exposure reduction, and the process can, as a result, accommodate all types of participants, regardless of whether they are sensitive to gross notional or not, and whether they can do terminations or not.

To learn more about SA-CCR, click here or contact us at info@osttra.com.