OSTTRA is now running FX optimisation and compression cycles together within 24 hours. Customers can optimise on multiple risk factors simultaneously whilst also benefiting from compression to minimise gross notional.

Changes in capital regulation taking effect:

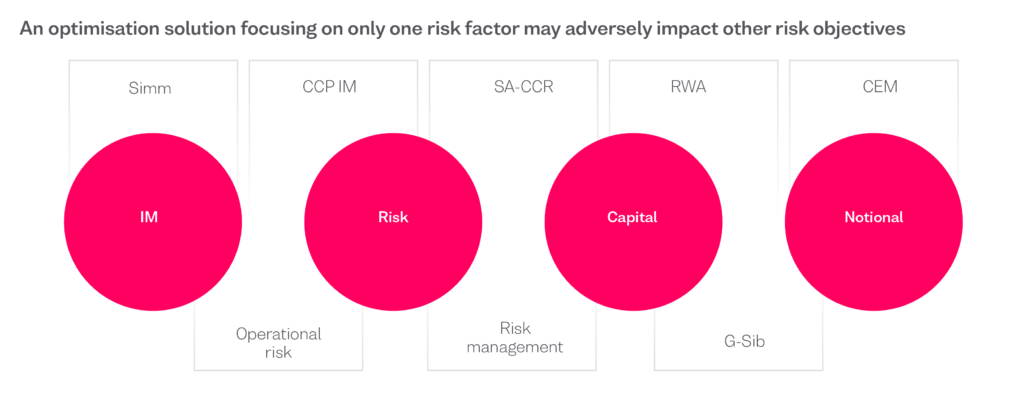

Over the course of 2022 we saw an increased client focus on optimising using risk-based capital models (SA-CCR & IMM), as well as on reducing SIMM and CCP IM using the OSTTRA triBalance service. However, overlay trades to optimise these risk objectives are notional additive, and gross notional reduction remains relevant for many participants.

By combining compression and optimisation, we can offer customers a solution that provides optimisation of multiple risk factors including SA-CCR, RWA, UMR IM, gross notional, and more, all within a 24 hour window.

Benefits:

- Multi-target approach

- Month-end opportunity to minimise added notional

- Reduced operational resources – due to reduced timeline and single data entry

- Incremental SA-CCR results through compression

- Wider network and participation due to ease of joining the cycles – creates optimal result for participants

To discuss your FX optimisation needs, contact info@osttra.com.